Last year—2019—was a good year for the U.S. economy, with a 2.3 percent growth in GDP, strong consumer spending and record-low unemployment. While there were talks of a looming downturn putting an end to the expansion cycle, no one could have forecasted the series of events that has since been unleashed across the country and around the world.

Bankruptcies are now up 20 percent since this time last year, and economists are projecting a historic wave of businesses shuttering due to Covid-19 over the next 18 months.

Amid this crisis, CEOs have had to pivot to new business models and implement drastic measures to survive and keep their businesses afloat—including big cuts to their own pay. According to a new Chief Executive survey of more than 1,400 U.S. companies across all sizes, industries, regions and ownership types, 38 percent of private company CEOs report having chosen to take a salary cut to help their company navigate the Covid crisis.

Our preliminary data—part of our annual survey of CEO pay—shows the average cash compensation package (base salary and bonus) for private company CEOs is down 15 percent from 2019, to $432,000 from $506,000. Looking at the median, total cash comp is down 19 percent, from $345,000 last year to $279,000 in 2020. More specifically, this represents a median cut of 7 percent in base salary and 62 percent in bonus pay.

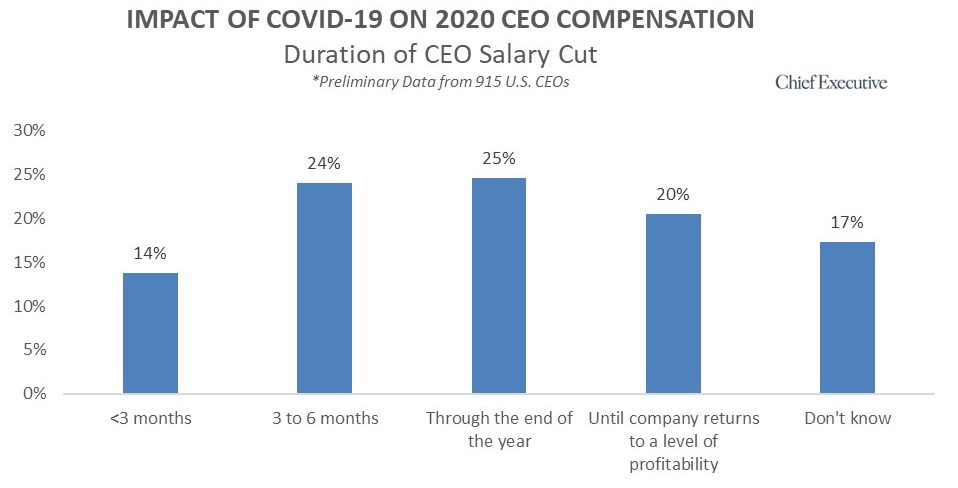

When asked for how long those cuts would be in place, the answers varied greatly, with a quarter planning to maintain the reduced compensation until the end of the year and another quarter anticipating it to last 3 to 6 months. Overall, one-fifth said they would keep the cuts in effect until the company returns to a level of profitability, and 17 percent had not yet decided.

Meanwhile, 26 percent of surveyed CEOs project their company will be unprofitable in 2020, although most said their EBITDA margin will be negative by less than 10 percent. In contrast, only 11 percent ended 2019 in the red—a stunning increase of 15 percentage points in just a matter of 3-4 months.

While these data points are good indicators of executive compensation trends across the country, more relevant benchmarking data will consider a host of other variables, including company size (by annual revenues and number of employees), sector and ownership structure. That detailed view (including quartiles) on base salaries, bonuses, equity grants and gains, benefits, perks and company compensation policies and practices, as well as how these elements vary by size, industry, ownership type, geographic region and other key variables, will be presented in our 2020-21 CEO & Senior Executive Compensation Report for Private Companies scheduled to be published in the fall. You can preorder your copy at CompReport.ChiefExecutive.net.

For those interested in participating in the study, the 2020 survey will remain open until June 6. All respondents who complete the survey will receive a 50 percent discount off the purchase of the full report, as well as an executive summary of the 2019 compensation data (upon completion of the survey), an executive summary of the 2020 data (upon publication of the report) and an entry into our raffle for a $1,000 Amazon gift card. Visit SurveyMonkey.com/r/ExecComp2020 to participate.

Every year, Chief Executive surveys more than 1,500 companies about their previous year compensation levels and practices, as well as their expected compensation levels for the remainder of the year. While most data sources on CEO compensation focus on large public companies, our research brings real-world insight into the compensation of CEOs of the approximately 6 million private companies in the U.S., not just the S&P 500. Visit CompReport.ChiefExecutive.net to learn more about what’s in the report and how you can pre-order your copy today.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.