New Poll Finds Canadian CEOs Optimistic For Future Rate Cuts And A Shift In Ottawa

Canadian CEOs aren’t feeling very confident in the current business environment across Canada, rating business conditions on average a mere 5.9 on a scale where 1 is Poor and 10 is Excellent.

Continued high interest rates and cost of capital, declining productivity, government spending and the persistent challenges pertaining to finding and retaining talent are just some of the main challenges they say are affecting their ability to grow—and even survive.

But when asked about their outlook for the next 12 months, nearly half said they expect it will get better—forecasting conditions will improve to 6.3 out of 10—a 6 percent improvement in business conditions compared to today.

Those were the topline takeaways from an inaugural survey of Canadian CEOs conducted in August by The Chief Executive Group, longtime publishers of Chief Executive magazine, in partnership with MacKay CEO Forums. Since 1977, The Chief Executive Group has worked to improve the performance of CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society.

Chief Executive Group routinely polls hundreds of U.S. CEOs, CFOs, CHROs and board members throughout the year to build our CxO Confidence Index series. The Index provides insightful data into business trends and what will likely shape strategies for the year ahead. In August 2024, we expanded our research efforts to Canada. (To receive future research insights and/or subscribe to our complimentary newsletters, visit us at https://chiefexecutive.net/chief-executive-enewsletter-signup/.)

In our new survey, we found CEO optimism largely based on slowing inflation and a series of expected interest rate cuts by the Bank of Canada before the end of the year, which they hope will reignite demand, as well as a potential change in leadership on Parliament Hill that many said would hopefully go to a party that can better support businesses.

“Reduction of interest rates and the expectation of Trudeau’s departure from office,” answered one of the 300 CEOs participating in the survey.

“Interest rates dropping and the hope of Conservative government,” echoed another CEO.

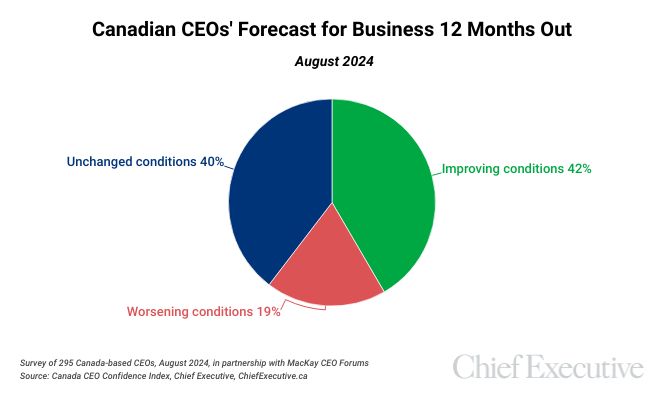

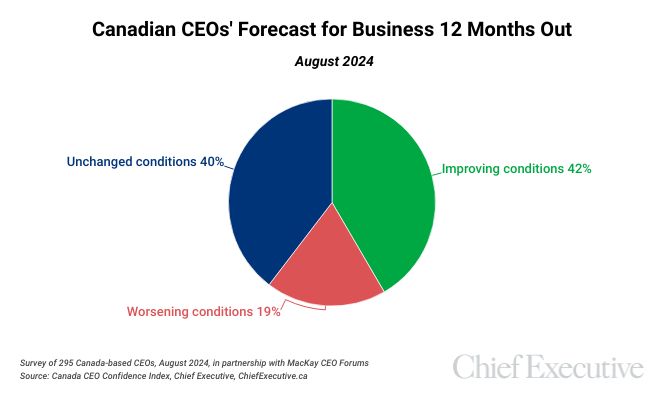

Overall, 42 percent of CEOs we surveyed expect improving conditions over the next 12 months, while 40 percent say it is more likely to be more of the same. Only 19 percent forecast deteriorating conditions.

As can be expected, the data shows variances exist when looking at different demographics.

From a sector perspective, we find CEOs operating in the agriculture/forestry sector, as well as those in financial services and professional services, showing less optimism than peers when it comes to the business conditions they expect will be in place by this time next year. All three groups rated their forecast for business 12 months from now below 6 out of 10—or approximately 5 percent lower than the cross-sector average. And agriculture/forestry and finance were the only two sectors where we found CEOs forecasting declining conditions over the coming year.

“We are losing talent to the U.S.,” said a financial services CEO. “It takes too long to get things approved in Canada.”

“Liberal government is really harming business,” said another CEO in finance. “I’m optimistic we’ll have an election before this time next year to help bring things back on track.”

“Clients are not proceeding with their projects,” added one CEO in the professional services sector. “Receivables are taking an average of 35 to 50 additional days to collect. Typically, we would collect 55 percent of our receivables from the previous month billing within 45 days. It is now down to 20 percent in the 45 days following invoicing.”

“Overall worldwide uncertainty is creeping into the rhetoric,” summed up one CEO, noting concerns over the high cost of debt financing, weak CAD, natural gas prices, the political environment at all levels and uncertainty surrounding the U.S. Presidential race.

On a more optimistic front, tech CEOs are expecting the best conditions of the group—6.6 out of 10—5 percent above the cross-sector average, mainly due to companies increasing their digitalization efforts and adoption of emerging technologies, they said.

“For the past three years, we have observed companies hesitating to make significant decisions due to the recession,” said the CEO of a technology company. “However, we now sense that organizations are eager to digitize and optimize their processes and are ready to move forward.”

It is worth noting that CEOs of tech companies are already enjoying good conditions, according to respondents in that sector, so their forecasted improvement 12 months from now isn’t as marked as in some of the other sectors.

For instance, advertising/marketing CEOs, construction CEOs and wholesale/distribution CEOs are all forecasting double-digit improvements in the business landscape for their respective sectors, largely above peers in other industries.

“Inflation is back to manageable levels, so we should start to see positive impacts from that in the coming 12 months,” said one of the construction CEOs participating in the survey. “We also have a large backlog, and there are currently more opportunities in the market than we are able to pursue.”

“Slowing inflation and lower interest rates are allowing projects to start moving ahead again,” added another construction CEO.

Variations in confidence and optimism also exist by region. CEOs headquartered in the Atlantic provinces came out as most pessimistic about the year ahead—rating their outlook 4.4 out of 10—while CEOs operating across BC and the Prairies were the most optimistic, with forward-looking ratings of 6.4 and 6.5 out of 10, respectively.

We also observed variations in forecasts based on ownership type. PE-backed CEOs shared the highest forecasts for business 12 months from now, 6.8 out of 10, while CEOs at sole proprietorships and other-investor-owned companies had the lowest outlook, 5.9 out of 10.

Still, CEOs at employee-owned companies expect the biggest improvement in business conditions 12 months from now, +12 percent, from 5.8 to 6.4 out of 10.

Overall, 71 percent of the CEOs participating in the survey said that despite challenging conditions, they still expect to increase revenue over the next 12 months, and 63 percent say the same about their profits.

When it comes to hiring and deploying cash, however, those numbers drop, with 46 percent planning to add to their workforce in the coming year, and 49 percent expecting to increase capital expenditures during that time. For both measures, the majority of those forecasting increases say it will be by less than 10 percent.

Chief Executive Group polls hundreds of U.S. CEOs, CFOs, CHROs and board members throughout the year to build our CxO Confidence Index series. The Index provides insightful data into business trends and what will likely shape strategies for the year ahead. In August 2024, we expanded the series to Canada, with this first Canada CEO survey, which we conducted in partnership with MacKay CEO Forums.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.