Corporate Board Members Grow Confident In 2021 Economic Recovery

Nearly one month into the new year, directors’ confidence in 2021 business conditions continues to climb, as hopes that a successful Covid vaccine rollout will soon put an end to lockdowns and restrictions—with three-quarters forecasting increases in profits and revenue by the end of the year.

Corporate Board Member’s January polling of 122 U.S. public company board members, conducted January 16-21 in partnership with the Diligent Institute, shows many directors are encouraged by a return to political stability and global commerce. Director confidence in the current economy is now at a 5.9 on our 10-point scale, up 5 percent since December.

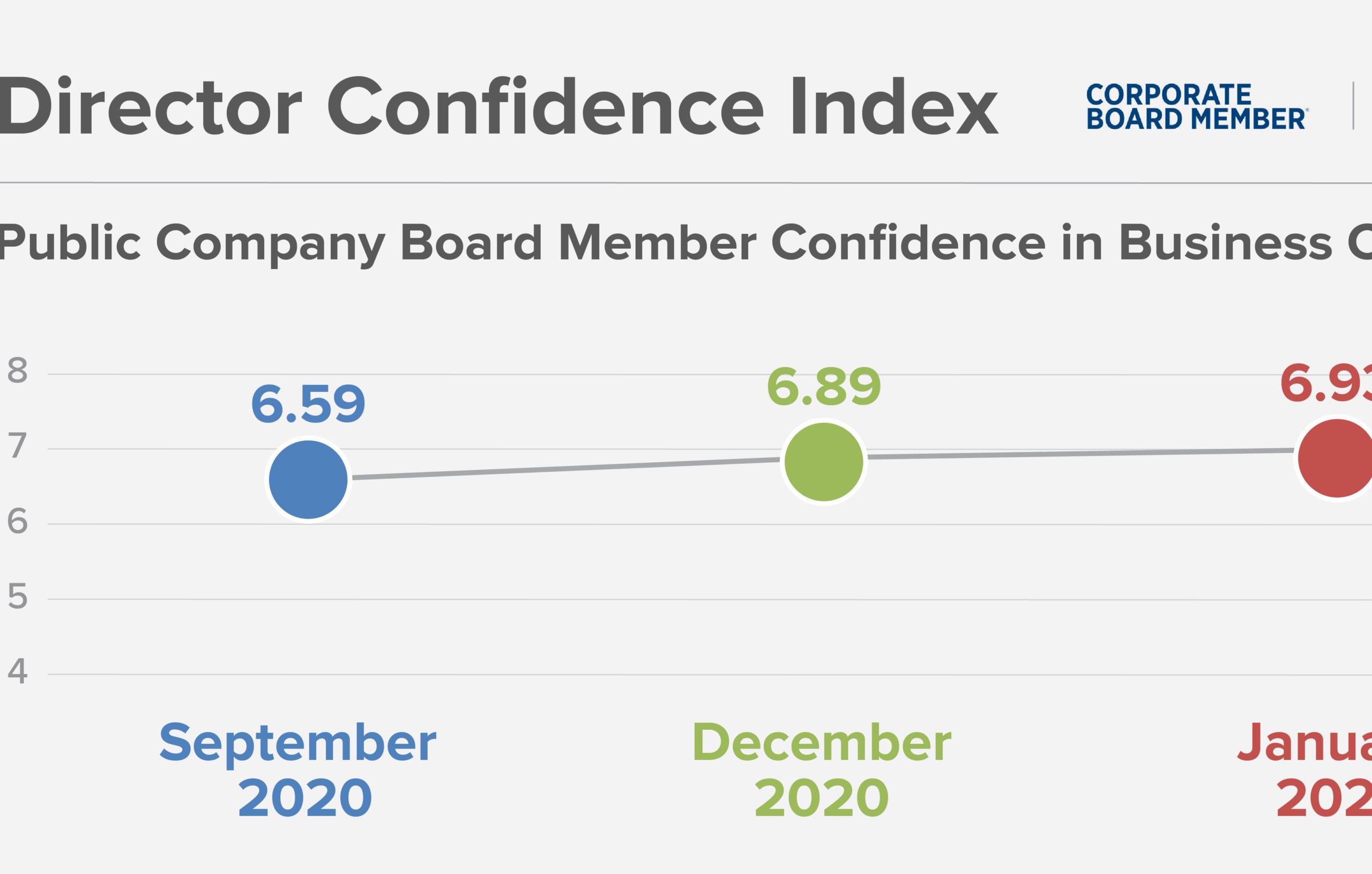

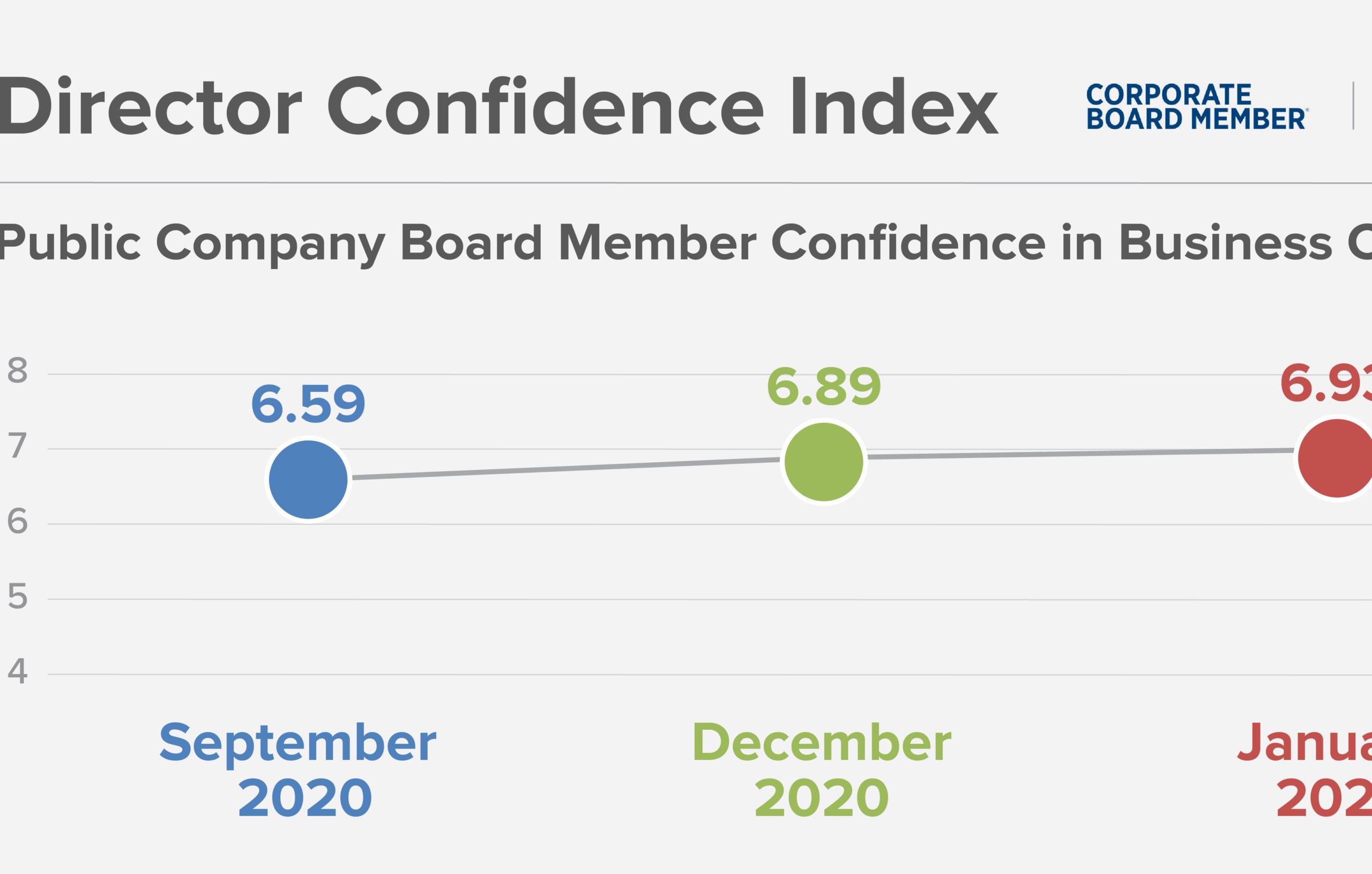

When asked about their outlook for the economy 12 months from now, directors scored it 6.9 out of 10, unchanged from our last reading the month prior. Sixty-two percent of them rated their outlook as “Very Good” or “Excellent” (7/10 and above), and only 11 percent rated it below 5—half the number of ratings 5 or below received last month.

“The distribution of the Covid vaccine should allow business to get back to pre-pandemic level by Q1 or Q2 2022,” says Gary A. LeDonne, a director at MVB Financial, who rates his outlook for future conditions an 8 out of 10.

Echoing last month’s sentiment, the continuation of the Covid-19 vaccine rollout, pent-up demand and hope for further stimulus packages are the main reasons behind directors’ rising optimism. This month’s reading now shows directors, CEOs and CFOs all on the same page about their outlook for future conditions, teetering around a 7/10 rating across each group, each with similar reasoning for their forecast.

“Current performance relative to the current economic environment is very good and will be even better when the economy recovers,” says a very optimistic committee chair at an insurance company, rating future conditions a 10/10. “Post-Covid recovery will be strong and amplified by high stimulus level.”

“Herd immunity achieved in 4th quarter this year or 1st quarter next year, assuming that distribution problems [are] taken care of and moderate stimulus package passed,” says the committee chair of a Materials company when asked to explain his “good” forecast of 6 out of 10, up compared to his rating of “weak” for the current environment.

Despite the optimism, directors remain cautious about how the vaccine rollout will impact business and its lasting effects on the economy, and fear that increased taxes and regulations will outweigh the expected increase in revenue. They are also concerned that additional stimulus packages might stifle long-term growth.

“Concern over higher corporate taxes reducing cash available for investment,” says an executive director at a Capital Goods company when asked to explain his 5/10 rating of the future environment. “Re-opening the U.S. to low-cost imports without tariffs will restart the decline of industrial manufacturing in the nation.”

“Successful vaccine, successful rollout of that vaccine, another dose of government stimulus. Offset some by new administration adding more regulation and stimulus, adding to the risk of inflation/higher interest rates on the horizon,” says a peer director at another Capital Goods company who rates future business conditions a perfect 10/10.

“If the Biden Administration can leave the economy alone, I’m optimistic,” says a member of the board of a transportation company who rates future conditions an 8 out of 10. “If they start putting in many regulations and raise taxes, I’m not so optimistic.”

Overall, however, directors seem to agree: “The coming year is the hardest to predict in history given the pandemic and its sequelae, and political and social unrest, including a new president,” said the director of a small pharma company, echoing the sentiment of many others.

Three-quarters of board members say they anticipate increases in profit and revenue over the next 12 months, at 73 and 75 percent, respectively. That is 2 percent fewer than last month but still 22 percent more than the number who forecasted similar increases just a few months prior, when we polled them at the end of September.

These numbers are in line with those of CEOs, whom we polled on the same issues January 5-7: 75 percent forecast revenue growth in 2021, and 72 percent expect profitability to increase over the same period, up 11 percent since December.

Further highlighting directors’ confidence in the future is the proportion anticipating their companies to increase capital expenditures in 2021: 42 percent this month, up 10 percent from December and much more aligned to the proportion of CEOs also predicting an increase in investments this year (48 percent).

Directors are also expecting their company to increase cash and equivalents, while decreasing debt. Sixty-eight percent say they will increase their cash position in 2021, up 22 percent since last month, and 33 percent expect a decrease in debt over the same period.

Across sectors, the data shows a less conforming view, with directors in certain industries breaking from their peers’ optimism and reporting lower confidence compared to the fall of 2020. Optimism for directors in the Energy sector, for instance, retracted 6 percent this month, on fears of intensifying regulations, increased prices and a host of other obstacles clouding the sector’s future.

“The oil industry fundamentals do not look very promising due to Covid-related restrictions, capex cuts and limited investment capacity from national and international oil companies,” says the non-executive director of an Energy company who rated his outlook a 6 out of 10, in somewhat neutral territory.

Directors in the Industrials and Materials sectors also reported a decline in confidence, albeit at lower rates, down 3 and 1 percent, respectively.

On the upside, directors in the Consumer Discretionary sector showed an +8 percent increase in confidence this month, after a 3 percent drop between September and December of 2020. They cite a recovering economy, anticipated government spending in infrastructure and the vaccine as the main reasons feeding their confidence.

The events of 2020 shed a spotlight on racial and environmental justice and brought the diversity, equality and inclusion discussion back to the forefront of the agenda in many boardrooms. Following new laws in the state of California, Nasdaq also imposed a board diversity quota, and nearly half of the directors we polled in December said they are in favor of such mandates.

When asked if they intend to tie executive compensation to DEI metrics, an impressive 40 percent of directors in our survey say their board is either planning to do so or already doing so. Only 27 percent say they have not discussed doing this at all, and fully one-third say they have discussed it but have either opted against it or so far made no plans to move forward.

Of those surveyed, fewer report tying environmental metrics to executive compensation: 25 percent of board members say their company is already doing this or planning to do so in the near term, vs. 43 percent who say they’ve discussed the idea but chose not to pursue it, and 31 percent who have not discussed it at all.

As explained by one director who completed the survey: “Sustainability and diversity are part of our compensation considerations, but the approach is more judgmental at this time vs. a strict mathematical approach. We are continuing to evolve in this area.”

About the Director Confidence Index

The Director Confidence Index is a quarterly survey of public company board members on the state of the overall economy, the outlook for corporate finances and other topical issues impacting public companies. Conducted in collaboration between Corporate Board Member and Diligent Institute, the Index benchmarks confidence among the governance community and is a forward-looking indicator of market movements and corporate strategies. The January survey was fielded from January 13 through 21, 2021.

About Corporate Board Member

Corporate Board Member, a division of Chief Executive Group, has been the market leader in board education for 20 years. The quarterly publication provides public company board members, CEOs, general counsel and corporate secretaries decision-making tools to address the wide range of corporate governance, risk oversight and shareholder engagement issues facing their boards. Corporate Board Member further extends its thought leadership through online resources, webinars, timely research, conferences and peer-driven roundtables. The company maintains the most comprehensive database of directors and officers of publicly traded companies listed with NYSE, NYSE Amex and Nasdaq. Learn more at BoardMember.com.

About the Diligent Institute

Diligent Institute is the corporate governance research arm and think tank of Diligent Corporation. The Institute produces publicly available cutting-edge research on corporate governance practices by directors, for directors, with a global perspective. Learn more at diligeninstitute.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.