2022 Year in Review: How CEOs’ Predictions Stacked Up

The year 2022 has been notable by any standard. Although it began with an outbreak of Omicron, the nation quickly recovered and many businesses saw unprecedented demand. That demand persisted, despite soaring inflation—so much so that goods and labor shortages fast became the norm. Meanwhile, Russia invaded Ukraine, igniting the first European land war since WWII and further disrupting global supply chains.

Though since the earliest days of the pandemic business leaders have faced seismic challenges that forced them to prepare for the worst, had they girded for the degree of disruption and volatility that 2022 ushered in?

Turns out, most were hoping for somewhat greener pastures.

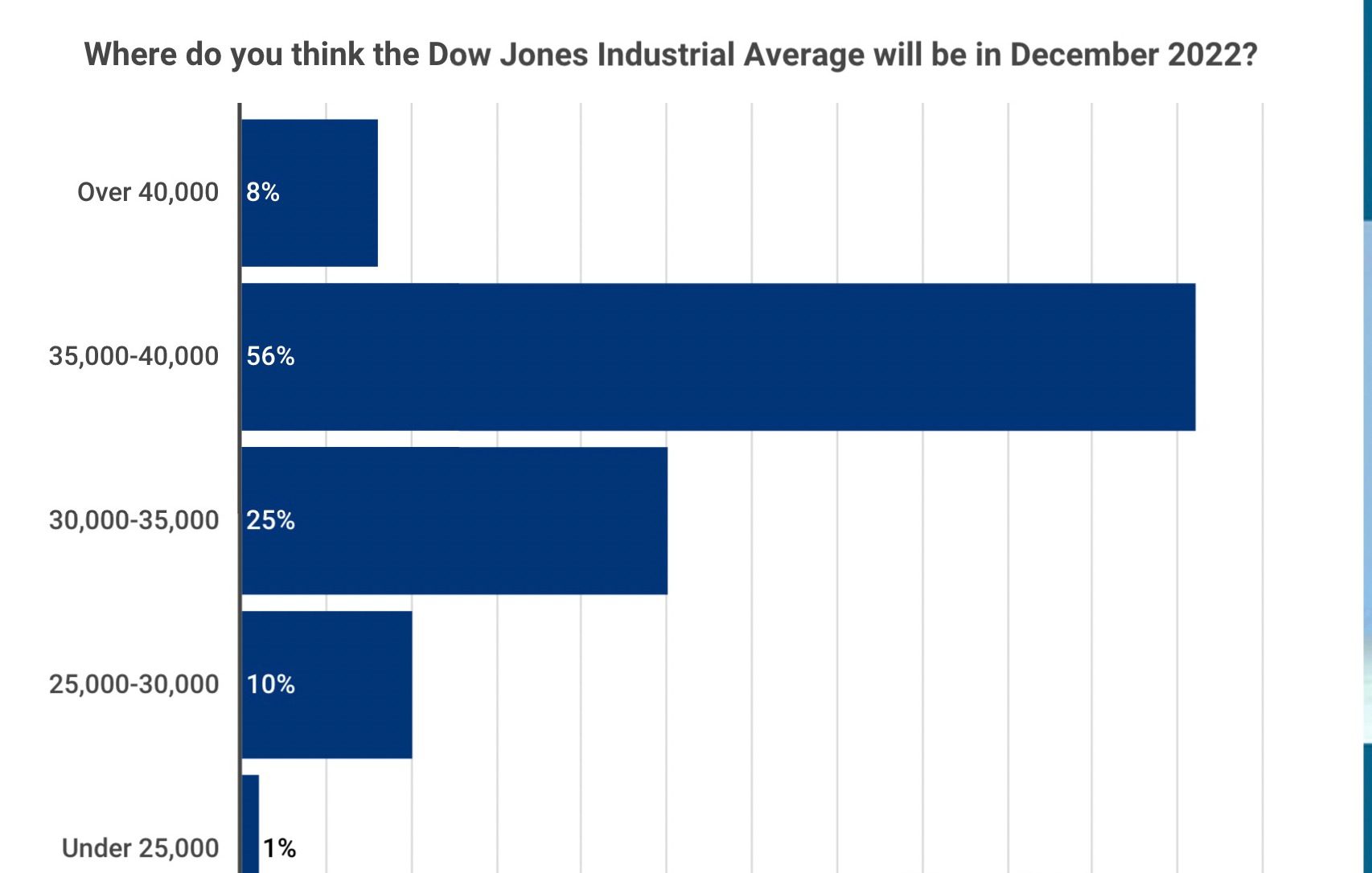

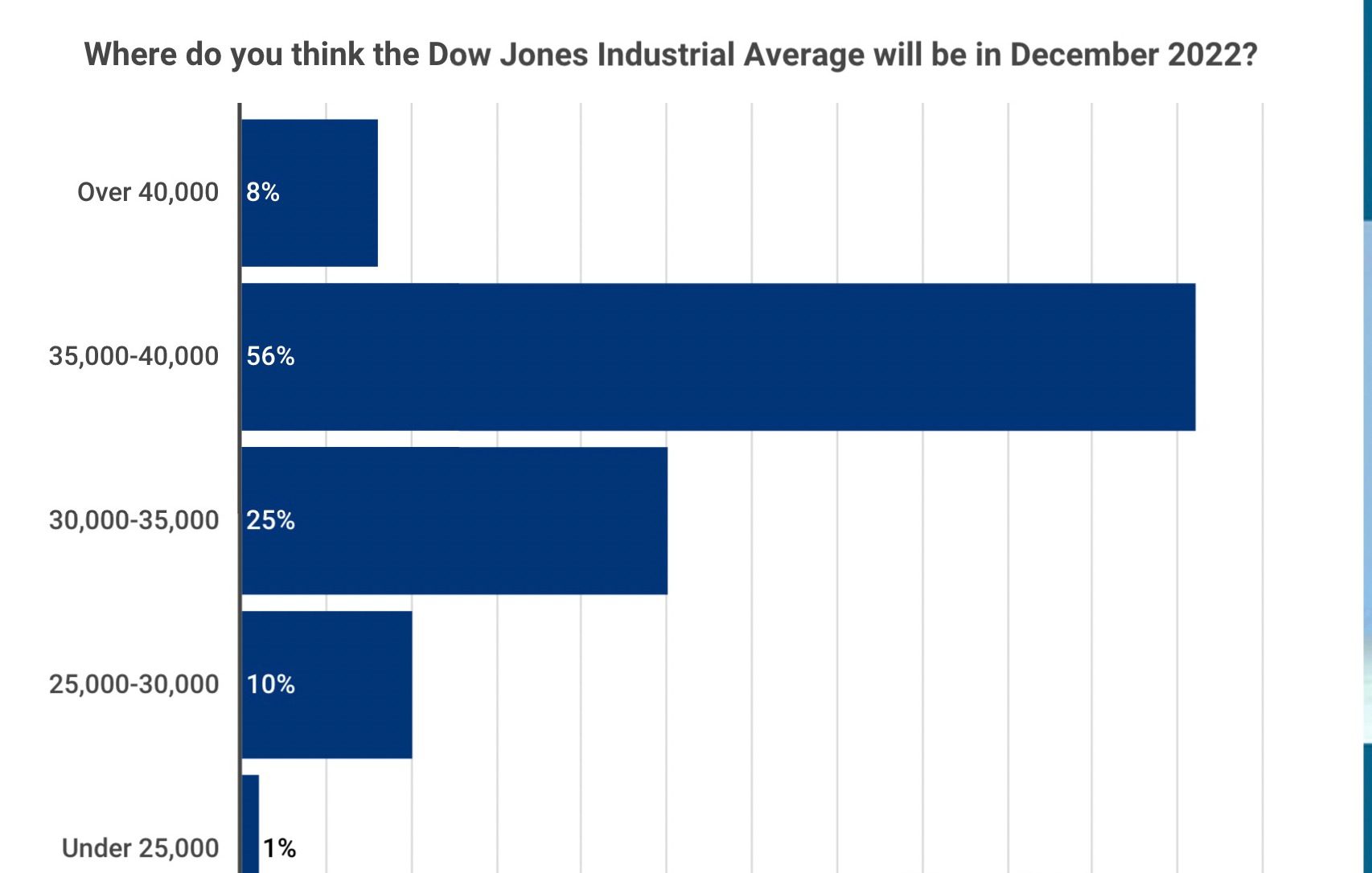

When asked in December 2021 to forecast where the Dow Jones Industrial Average would close 2022, the majority of the 150 CEOs we polled said between 35,000 and 40,000. That might be considered fairly conservative, considering the predictions were made before the onslaught of events that unfolded in the months to come, and the year hasn’t ended yet—there’s still room for a Santa Claus rally—but those figures will likely be above the final results.

CEOs were also asked whether they expected a U.S. recession in 2022. While there’s still ongoing debate over whether the U.S. has technically been or remains in recession, 61 percent gave us a flat out ‘no.’ One-third of CEOs said there would be a recession, but that it would be mild.

And although the GDP numbers fell twice in a row in Q1 and Q2 of this year, according to the Bureau of Economic Analysis, and did fit the unofficial definition of a recession (two consecutive quarters of negative economic growth), unemployment continued to fall and demand didn’t recede until later on. The nonprofit National Bureau of Economic Research, the official arbiter of recessions, never declared one.

So which CEOs had it right? The jury, as they say, is still out. What can be said, however, is that google searches for “recession” and “are we in a recession?” between the months of October 2021 and December 2022 peaked in June 2022, with both terms being searched more than 3 times as often now, compared to one year prior.

Where will the Dow be this time next year? What about Fed rates? Inflation? Scroll down to share your predictions for 2023 or click to open in a new tab.

But perhaps the kicker is that when CEOs were asked about inflation, 37 percent predicted the squeeze would get worse in 2022, compared to 2021, though only 11 percent had forecasted inflation would get ‘much worse.’

A close second was the forecast that inflation would be flat in 2022, with 35 percent of CEOs choosing that answer—and only 17 percent expecting inflation to subside.

Considering inflation had peaked at 7 percent in the same month we asked CEOs to forecast 2022, it’s tough to say who got it right between those who said it would get worse and those who said it would be much worse. On the one hand, we did experience the highest inflation in 40 years this year, but the peak was not too far off December levels, hitting 9 percent in June 2022. So it’s safe to say that the 48 percent of CEOs who predicted that inflation would worsen—to any degree—got it right.

The Fed’s policy was also an item on the December survey. CEOs were also asked to predict the Fed Funds Rate/Prime rate by December 2022. Nearly everyone expected it to increase from its December 2021 level, but most had expected the increase to be between 0.5 and 0.75 percent. Only 13 percent predicted increases above 1 percent—and looking at the answer choices on the board, neither did we.

Don’t see the embedded survey? Click here to open in a new tab.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.