SPECIAL REPORT: After The Covid Cut—How The Pandemic Affected Compensation Trends

Last year, in the midst of the pandemic, Chief Executive surveyed more than 1,400 private U.S. organizations on their compensation strategies and the actions they were taking, if any, to navigate the crisis. Our research found that by late June, two companies out of five had cut or planned to cut their CEO’s base salary in response to the crisis—the majority of which reported cuts of 10 to 30 percent overall.

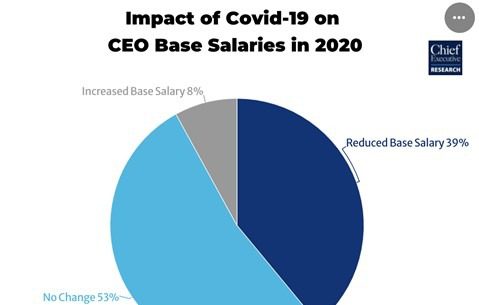

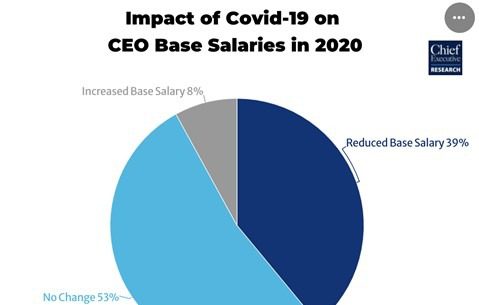

New data from Chief Executive’s 2021 CEO & Senior Executive Compensation survey, fielded from April through June 2021, confirms that approximately 40 percent of companies did reduce their CEO’s base salary in 2020, but also finds that these cuts were not as steep as had been expected 12 months earlier—a demonstration of the perseverance of companies across the U.S.

What’s more, the majority of firms that instituted pay cuts last year have since made their CEOs whole again by reinstating pre-Covid compensation levels, and 8 percent of companies surveyed in 2021 report that they increased their CEO’s base salary last year in response to how their company navigated the Covid-19 crisis.

Those are among the preliminary results from our 2021-2022 CEO and Senior Executive Compensation Report for Private Companies—the largest such annual survey in the nation—which is aimed at providing companies with valuable guideposts to measure themselves against their peers and strengthen their compensation strategy. (Learn more about the report > )

The pay snapback won’t surprise many. With so much uncertainty surrounding Covid-19 in the spring of 2020, companies were preparing for the worst. At the time, nearly a quarter (22 percent) of the companies that had reduced or were planning to reduce their CEO’s base salary were considering cuts of more than 50 percent. When polled in the spring of 2021 however, only 14 percent reported having actually reduced the CEO base salary by more than 50 percent in 2020—36 percent fewer companies than expected.

Similarly, of the companies surveyed in 2020 that had planned to cut CEO base salary, only 8 percent expected those cuts to be less than 10 percent—most forecasting the cuts to be much larger—but 2021 data shows 13 percent in fact stayed within that modest range.

Overall, our research finds that the weighted average reduction to CEO base salary in 2020, specifically among companies that cut salary due to covid, was 27 percent—22 percent less than what had previously been forecasted.

It’s important to note that for many companies, this reduction was not in place for a full year—as the crisis only began to impact U.S. operations in the second quarter, and many companies eliminated the cuts within a few months. In fact, among companies that reduced senior executive salaries, 76 percent did so for less than 6 months, although the weighted average duration of the cut for these companies was 6.2 months.

The majority of companies that instigated cuts to their CEO’s base salary had plans to make their chief whole again once the crisis subsided. Our most recent data finds that 56 percent offered recapture opportunities—in whole or in part. A full third report having repaid their CEO’s foregone salary, and another 23 percent expect to partially or fully replace the reduced salaries.

The 2021-2022 CEO and Senior Executive Compensation Report for Private Companies, which details the salaries, bonuses, benefits, perks and equity compensation levels and quartiles for CEOs and eight other senior executive positions (and how they vary by company size, industry, ownership type, growth rate, level of profitability and other key variables) will be released in early October 2021. To learn more, ensure your competitiveness and reserve your copy with a $500 pre-release discount, visit www.CompReport.ChiefExecutive.net.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.