Compensation Challenges And Opportunities In 2023

Many organizations are facing unprecedented and conflicting challenges as they determine their talent and reward strategies for 2023. A January 2022 Conference Board C-Suite Challenges Survey reported that the primary internal business challenge facing senior leaders is the attraction and retention of talent. This is juxtaposed against a more recent October 2022 KPMG survey that reported that nearly nine out of 10 CEOs expect a recession in the next 12 months. Adding fuel to this uncertain environment are the continuation of the “Great Resignation,” persistent and historically high inflation rates, and labor supply and demand imbalances for key roles and skill sets.

Taking all of this into account, it’s not surprising that organizations in all industries around the world have found it necessary to refine, if not significantly reengineer, their approaches to total rewards. A Korn Ferry pulse survey in February 2022 showed that organizations globally were planning higher increases in their salary budgets for 2023 and were also utilizing a variety of non-financial rewards to address emerging talent challenges. Since that time, many of our clients told us that they anticipated making even more changes for 2023. And that led us to conduct our most recent global pulse survey on rewards in October 2022 which generated responses from nearly 7,000 organizations in 112 countries.

Our latest survey indicates that most organizations (69%) have already experienced or are planning for a negative business impact due to the weakening economy, and half of organizations are slowing or freezing hiring activity in anticipation of a potential recession. However, in this last calendar quarter, most organizations (82%) had not yet made plans to reduce their workforce and a significant majority (67%) weren’t planning to reduce their salary increase budgets. We expect that this picture may morph in the coming weeks and months as a new economic reality takes hold.

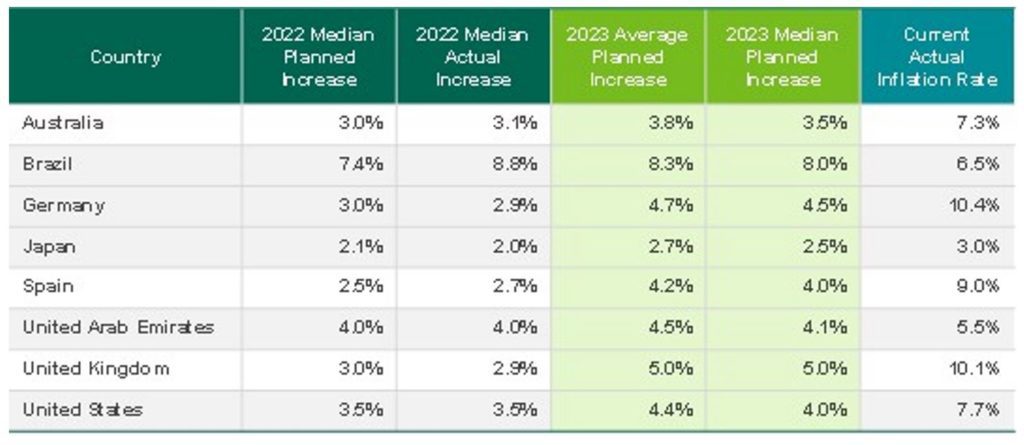

When it comes to base salary increase projections. We have not yet seen a slowdown. Our previous global rewards pulse survey in February 2022 showed consistent increases in salary budgets over the previous year, and our most recent survey indicates that many organizations are planning greater increases in their base salary budgets in 2023. Anticipated salary increase budgets for a sample of countries are provided below:

There is a delicate balancing act happening in many organizations where there is a need to:

• Be conservative in hiring activity and managing variable labor expenses, and

• Reward existing talent—and especially top talent—as competitively as possible

While the most recent base salary increase projections are the highest in years in several countries, they are still lower than current historically high inflation rates. Many may wonder why these increases are not keeping pace with inflation. The primary reason is that most organizations tie their base salary increase budgets to the cost of labor in relevant markets (as opposed to cost of living or inflation). While the cost of labor and cost of living/inflation usually directionally correlate, there are typically gaps between these two measures. For the past several years, labor cost increases have slightly exceeded inflation rates, and so salary increases were above inflation rates. But now we face a nearly unprecedented situation where inflation is at a 40-year high, unemployment rates remain low, and an economic slowdown is widely anticipated. As a result, organizations have increased their base salaries in recognition of a robust and competitive talent market, but salary increases are lower than inflation rates because of the prospect of a softening economy, and some organizations are also reducing or planning to reduce total staff to manage costs.

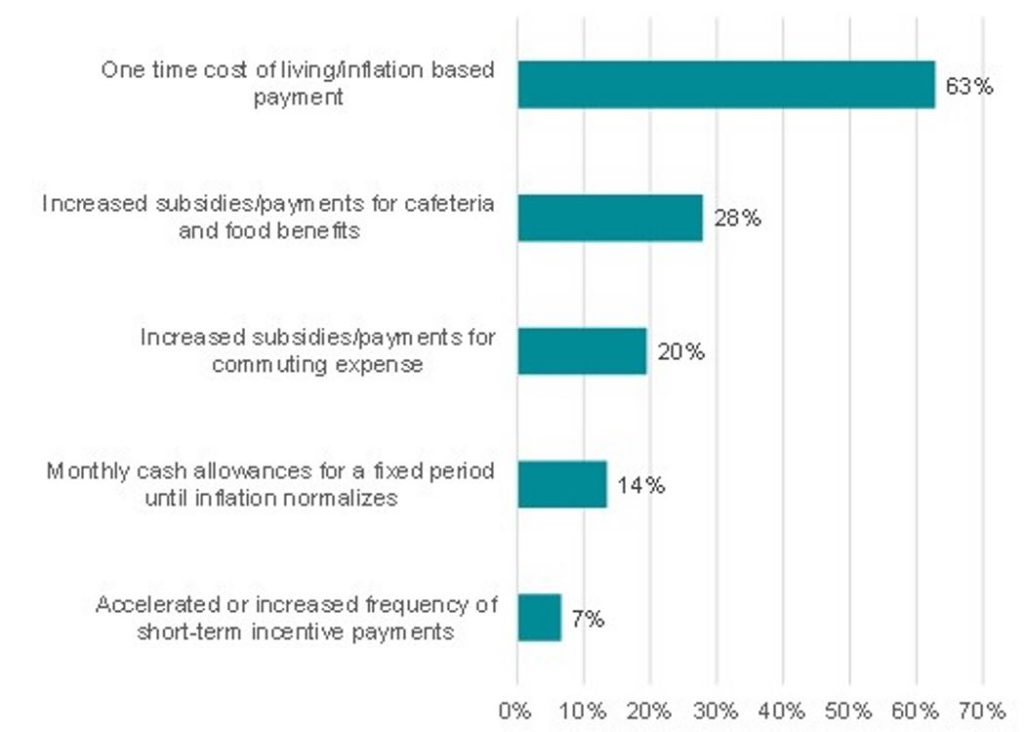

Some organizations have been compelled to provide additional compensation to reflect the current inflationary environment and these adjustments are often provided as part of a variable pay program (e.g., a one-time bonus) as opposed to an increase in base salary. So, they absorb a one-time increase in variable costs as opposed to building in additional fixed costs by providing more aggressive base salary increases. Twenty-seven percent of survey respondents reported providing supplemental compensation or benefits beyond a higher salary increase budget. Of those providing supplemental compensation, the most common rewards include one-time cash inflation off-sets, increased funding for onsite cafeteria/food benefits, and increased subsidies/payments for commuting expense. See the table below.

Our recent research indicates several additional labor market challenges facing organizations. While employee turnover is relatively low in many countries (and less than 5% in many cases), developed markets like Australia, United Kingdom, and United States are experiencing higher turnover than most other countries.

Most turnover is occurring in lower-level roles – including clerical/operations and supervisory/junior professionals. Across organizations, we see the Sales, IT, Engineering, Production and Finance functions with the highest turnover rates and the toughest challenges in talent acquisition. To combat this attrition, organizations are reporting increased utilization of talent development programs for key talent and high potentials as well as retention compensation programs for these same employee groups in focused efforts to retain top talent.

Organizations are also carefully navigating return to work programs to balance the need to bring employees back to the office with employee preferences that have been shaped over the past few years. A majority of organizations (69%) report that they are transitioning to bringing their employees back in the office—at least on a part-time basis. A majority of these organizations (73%) are not requiring employees to return to the office on a full-time basis. The most common number of days employees are expected to be in the office is 2-3 per week (59% of organizations). Only 27% of organizations are requiring employees to be in the office full time. Most employers (73%) report a mixed reaction from employees on the return to office policy, with relatively few (3%) consistently negative perceptions.

We find ourselves in an unprecedented situation as we continue to face an extremely challenging market for talent, a high inflation environment, and a turbulent economic climate. Rewards are getting more attention than ever, and HR professionals are being looked to for new answers to solve an increasingly complex question: “How do we get and keep the talent we need and responsibly manage our total labor costs?” Companies will be best served by utilizing a wide array of reward tools—financial and otherwise—to ensure they can effectively acquire, engage and retain the talent they need.

There are no magic bullet reward solutions in this environment. The most practical approach is to assemble relevant workforce data to understand what attracts and retains talent in your organization, and how your rewards stack up against others who seek the same talent you need. Work with your business leaders to align your approach with their needs, develop a game plan utilizing all the rewards tools at your disposal, and make sure your leaders are aligned around executing the plan and consistently communicating the key components.

Remember that the current environment is dynamic and fluid and it will require you to be able to flex as conditions evolve.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.