Healthcare Costs Continue to Rise: How Much Should Your Company Pay?

Perhaps you thought steep price hikes on everything from materials to labor were over? Think again. Recent data from Chief Executive shows that the cost of employer-sponsored healthcare is continuing to climb at a faster pace than inflation.

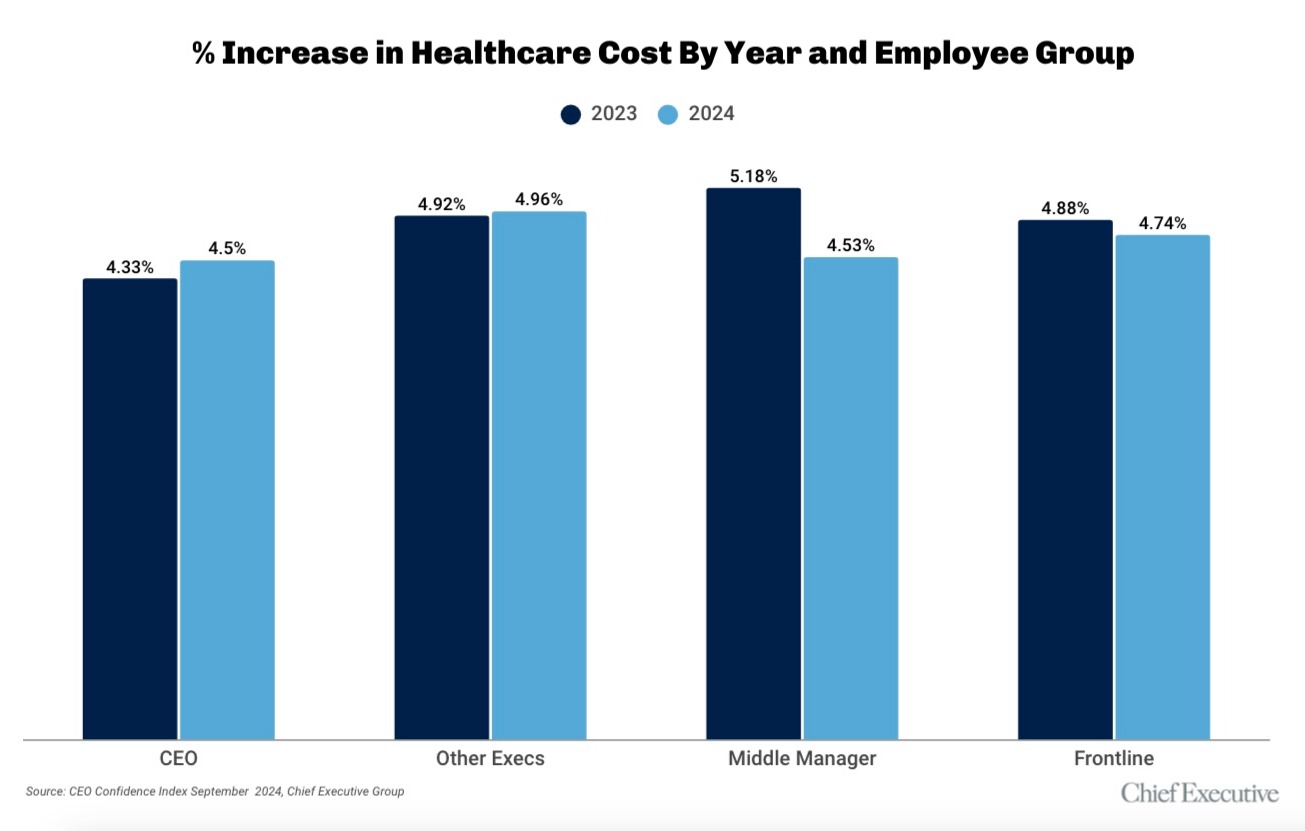

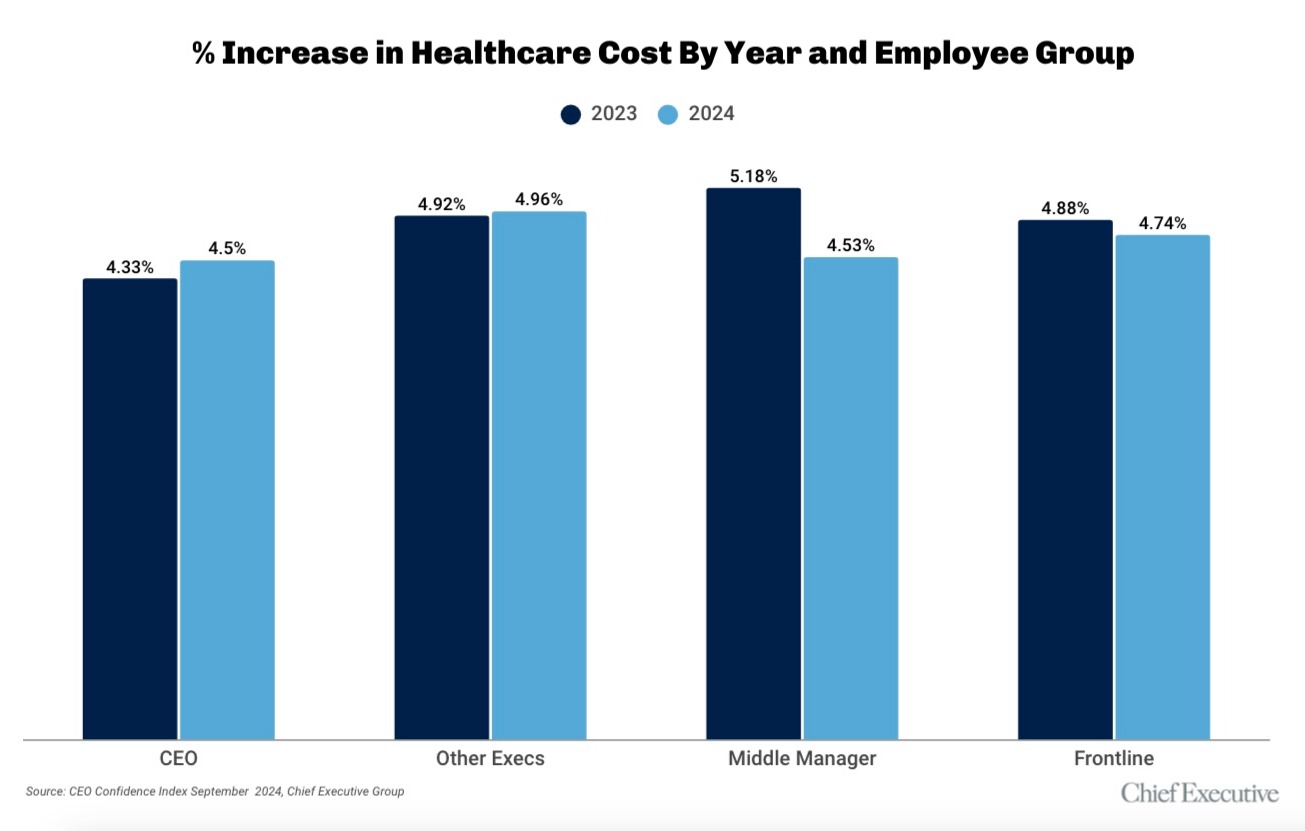

Many companies choose to offer different healthcare packages based on employee roles inside the organization. For instance, a company may have a healthcare plan for its CEO and senior executives and a different package for middle-managers and front-line workers.

In 2023, U.S. companies reported an average cost increase of 4.3 percent in the healthcare plans they provide their CEO. In 2024, that increase ticked up to 4.5 percent. For senior executive healthcare plans, the average increase was 4.9 percent in 2023 and 5 percent in 2024.

According to preliminary data from Chief Executive’s 2024-25 CEO & Senior Executive Compensation Report, private companies paid an average of $18,515 toward their CEOs’ healthcare plans in 2023 and $17,488 for other senior executives. This translates into an increase of $833 and $874, respectively, per capita for companies in 2024.

“Healthcare is largest expense other than material and wages,” said Jeff Hand, CEO of ROSS Controls, a large industrial manufacturing company.

The table below displays the cost of healthcare at the median and top quartile, to benchmark your company’s cost.

Meanwhile, healthcare plans for middle managers increased at the highest rate in 2023 compared to all employee groups, at 5.2 percent on average. However, in 2024, this rate decreased to 4.5 percent. Front-line/back-office employee healthcare plans increased at an average pace of 4.7 percent this year, also down, from the 4.9 percent increase employers reported in 2023.

CEOs across industries agreed that rising healthcare costs and navigating the insurance market is a top concern for their business.

“Healthcare costs in this country are way too high, and we have mediocre care compared to other countries around the world,” said Joseph L. Wegner, CEO at Community State Bank in Nebraska, echoing many others.

Differences by Company Revenue

Of course, when it comes to healthcare plans, not all companies are affected equally. Usually, larger companies with more negotiating power and higher employee counts are able to secure better, more stable rates. Small companies are more likely to have to bend to the will of the insurer or spend scarce time and resources securing better rates, not only for the company but for the employees as well.

Employer-sponsored health insurance can boost productivity and wellbeing in the workplace and is an important factor when recruiting top talent. Companies across all size categories prioritize contributions as a major benefit for their workforce.

So far, the proportion of the cost paid by the company has remained unchanged in 2024, compared to prior year (around 66 percent for all employee groups). But faced with these cost increases, many may be forced to rethink their strategy.

For companies with less than$50 million in annual revenue, the company’s contribution toward healthcare plans is highest for senior executives (excluding the CEO) than any other employee type, while in companies with revenue of $50 million or more, CEOs tend to receive the highest percent contribution from the company. This could be used as a strategy for smaller companies to attract top executive talent, when the CEO is more likely to be a founder or company owner, and they can’t compete with the cash compensation that larger companies can offer.

So, how has the cost of these contributions increased? Well, in 2023, companies with less than $10 million in revenue saw an average cost increase of around 5.8 percent to CEO healthcare. Fast forward one year and those companies are now seeing an average cost increase of 6.8 percent, compared to only 4.4 percent to their larger counterparts with $250 million or more in revenue.

Cost increases for health insurance for other senior executives were also the highest for companies with less than $25 million in revenue in 2023, at around 7 percent. However, in 2024, those rates decreased to around 5 percent, while larger companies’ rate of increase grew from 2.3 percent to 5 percent.

For lower-level employee groups the data reveals a similar pattern. Colossal rates of increases to health plans reaching over 7 percent in 2023 for smaller companies, and while they witnessed a drop in their rate of increase to around 5 percent, that of larger companies climbed from around 3 percent, up to 5 percent in some cases.

Regardless of where your company stands in terms of revenue, setting the right healthcare benefit at the right rate is paramount to your talent strategy. With rate increases topping inflation, you need to ensure your company is paying a fair amount. Median and top quartile dollar cost data for CEOs and other senior executive healthcare benefits by revenue range, ownership type, industry, EBITDA and more is presented in Chief Executive’s Annual CEO & Senior Executive Compensation Report.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.