CEO Confidence Rebounds On Rate Cut Hopes, End of Election

After two months of consecutive decreases in CEO outlook, September ticked up from August, with many of the 120 chiefs we polled September 10-12 saying that no matter the outcome of the election—and most have a preferred candidate—the simple clarity of knowing who will be the next president will at least allow them to make better informed decisions about the future.

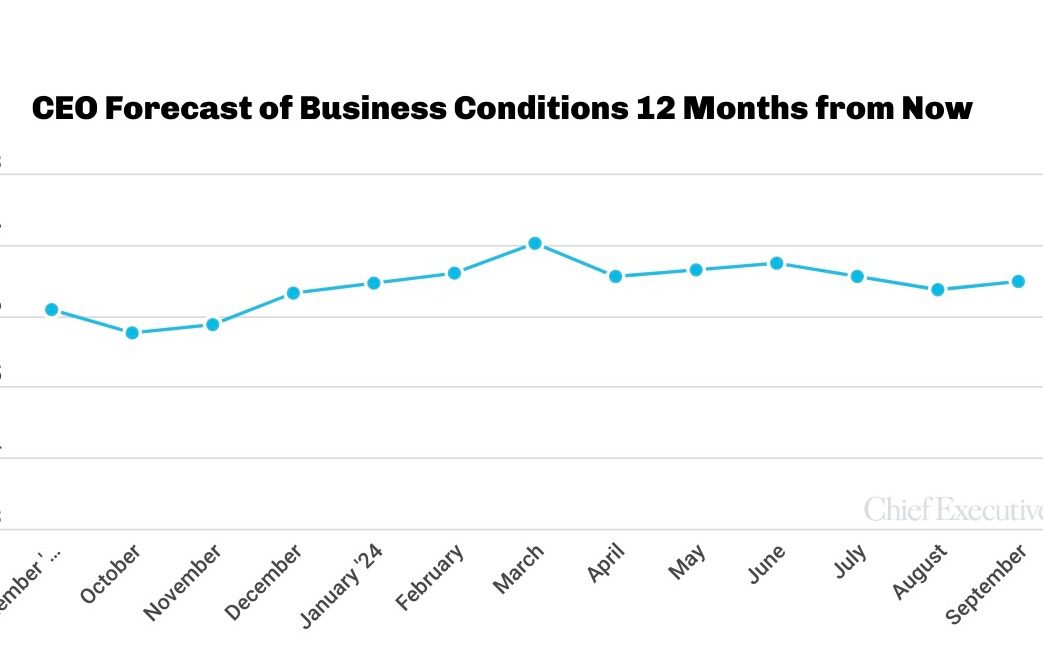

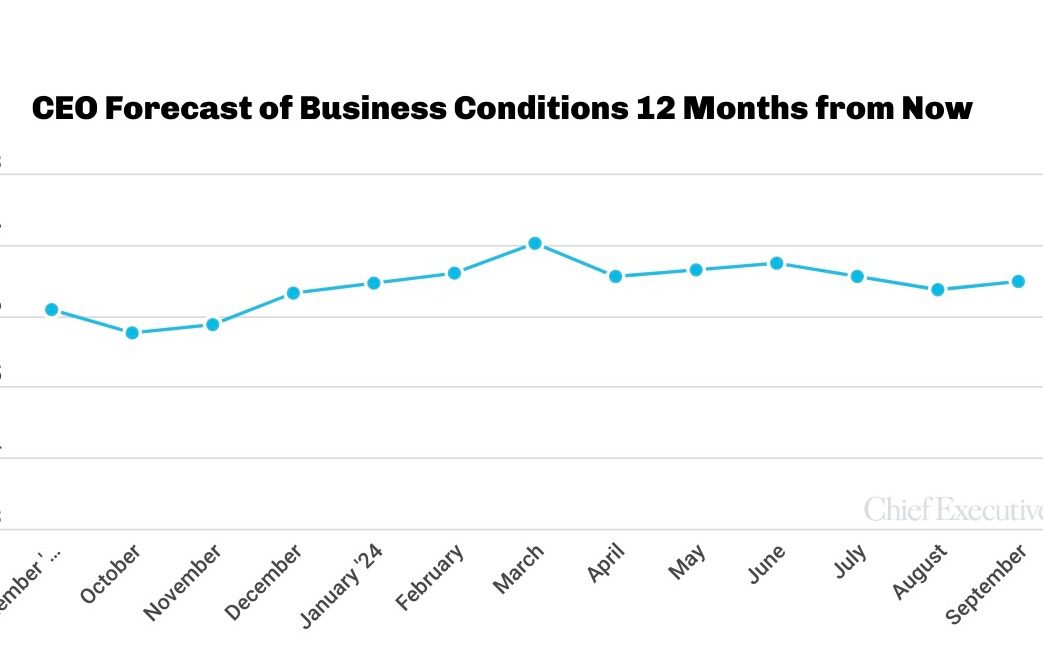

That isn’t the only reason for the stabling outlook, of course. Lower inflation and the expectation that the Fed will cut rates are also cited by CEOs as the key reasons behind their forecast of future conditions at 6.5 out of 10, up from 6.4 in August. CEOs’ rating of current conditions is at a standstill at 5.9 out of 10, unchanged from the month prior.

“Getting past the presidential election cycle will give leaders some opportunity to anticipate and prepare for whatever the future may be,” says Ron Price, CEO at Price Associates, a professional services firm. “This should also bring more predictability to the economy.”

Fred Sutter, CEO of Carlisle Fluid Technologies, an industrial manufacturing firm, agrees. “There will be increased investment in factories due to better economic certainty and lower interest rates,” he says, explaining why he expects conditions to improve.

Still, some CEOs say that the future is entirely dependent on the outcome of the election, “My views are singularly dependent on the outcome of the U.S. election. Due to the stark contrast in economic policy, it will determine business economics for the next four years and beyond,” says Steve Aldrich, CEO at Innovative Plasma Technologies.

Because of the split, 45 percent of CEOs forecast improving conditions, down one percent from last month. Nearly a quarter (24 percent) of CEOs now forecast worsening conditions—up 7 percent since August.

The biggest driver of caution: “Uncertainty with election outcome and ultimately the economy,” says Les Archer, president at Reynolds Construction, LLC.

Randi Rios-Castro, CEO of Jawonio Inc., a healthcare nonprofit, is clearer on her reasons for forecasting a slight downturn. “The job market is shrinking, consumer spending is shrinking, and credit card debt is high.”

Chad Smith, CEO at Liberty Advisors lists “macroeconomic global conditions—war, global economic confidence, election,” as reasons why he expects deteriorating conditions.

The proportion of CEOs forecasting increases in revenue over the coming year climbed 6 percent, clawing back some losses from the previous month, now at 69 percent. Forecasts for profits, however, fell 5 percent in September, hitting the lowest proportion since March of this year, with only 59 percent of CEOs forecasting increasing profits over the next 12 months.

In light of profit struggles voiced by many CEOs, this month, Chief Executive asked about strategies to maintain and grow profit. Two-thirds of CEOs said that they plan to expand their market reach, by far the most popular strategy. Following that, 53 percent said they plan to adopt new marketing and sales strategies, and the third most popular strategy is to cut operational costs, which 50 percent plan to do.

The proportion of CEOs projecting increases in capital expenditures rose this month, up to 45 percent from 39 percent last month.

When it comes to hiring, 51 percent of CEOs said they plan to increase headcount in the next 12 months vs. 45 percent in August. This is the highest proportion since March of this year and one of only three months, out of the last 12, where the proportion of CEOs who say they will increase hiring is above 50 percent.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. See more about the Index and prior months data.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.