New Poll Finds CEOs Bracing For Recession

Sharp turns of events shouldn’t surprise any of us anymore, after more than four years of constant—and often unprecedented—disruptions. But the recent soft jobs reports, temper tantrum in global markets and the increased chatter over the probability of a hard landing were enough to deter CEO confidence and raise fears of a recession in the first week of August.

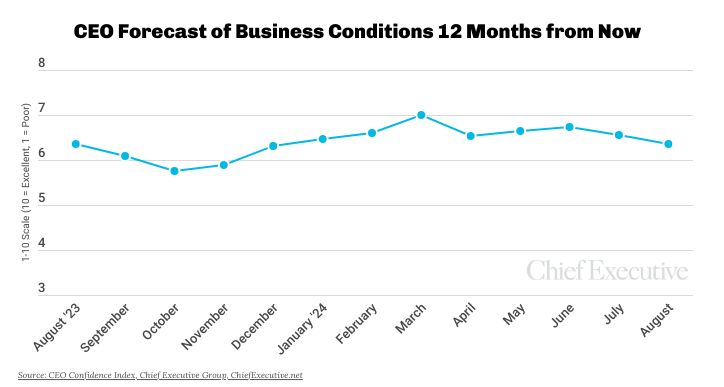

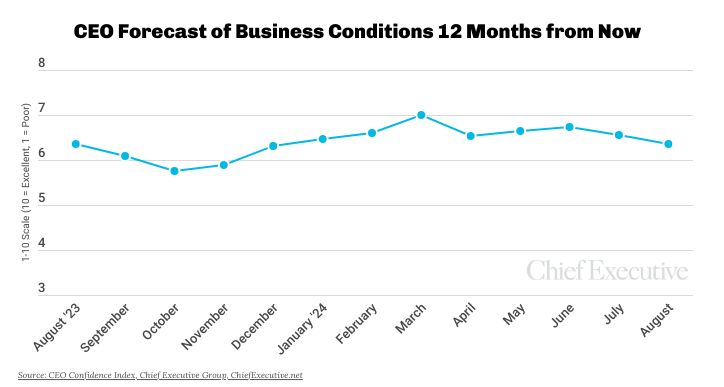

Three out of five of the 167 CEOs we polled August 6 and 7 said they expect a recession in the U.S. over the coming months—with some noting it was now too late to avoid it. CEOs’ forecast for business conditions 12 months out slipped to 6.4 out of 10, on a scale where 10 is Excellent and 1 is Poor. That is the lowest level of the year and a 9-percent drop since the 2024 high reached in March (7/10). CEOs’ assessment of current business conditions also dropped, also by 3 percent, to 5.9 out of 10 from 6.1 in July.

“The Fed has likely waited too long to begin easing for a soft landing,” said Dan Zureich, president and CEO of Lawyers Mutual of NC.

“I think we’re already in a recession—the Fed just hasn’t figured it out,” added IAG Insurance Services CEO John Kookootsedes.

Some CEOs say how that all plays out is highly dependent on who wins the White House in November. “It appears based on the present economic data that we’re sliding into a recession. To what extent will be determined by the next U.S. President,” said Steven A. Schneider, executive chair and CEO of PennStar Group, LLC.

Overall, only 32 percent said a soft landing is possible, though even in that group, some are bracing for the worst. “Expecting a mild recession,” said Douglas Clark, executive chair and founder of procurement and finance solutions firm Corcentric, “[but] planning for a severe recession.”

Interestingly, these numbers resemble those we found when we last asked CEOs last fall to rate the likelihood of a recession in the U.S. in 2024.

Chris Edelen, CEO of Safe Showers, LLC, says that delay in the Fed’s decision to start easing will affect business conditions because of “the time that it takes for that to feed into the economy.” For that reason, his forecast for business 12 months out is weak, at 5 out of 10—down from what he views today as a 7/10.

This doesn’t mean CEOs have turned negative on the future. Nearly half (46 percent) of those participating in the poll said they expect business conditions in the U.S. to have improved by this time next year. While that proportion is down 10 percent since July—when it shot up to a year-high of 51 percent—it is still well on par with the average proportion (47 percent) that has maintained a positive outlook so far this year.

And among those who don’t forecast improvements, a greater proportion (33 percent) expect things to remain as they are today, vs. 22 percent who anticipate a deterioration.

Overall, a plurality of CEOs expect conditions to continue to improve into 2025, but the extent of that improvement is moderating. “Inflation may slow, but consumers are stuck with inflated prices; these will not regress,” observed IPM Founder, President and CEO Cuono R. Panico. “The Fed will not be able to get the prime rate down sufficiently in the next year to boost confidence and spending.”

As one can expect, these economic forecasts are trickling down to individual company outlooks. According to our August data, 65 percent of CEOs now expect revenue to increase over the coming year (vs. 72 percent last month), and 62 percent expect the same of profits (vs. 64 percent in July).

Similarly, only 39 percent now plan on increasing capex in the coming months, vs. 53 percent in July—a sharp drop of 26 percent.

One area not affected by this down trend appears to be technology budgets. Sixty-eight percent of CEOs plan to increase their capital allocation toward new tech capabilities such as GenAI in 2025. That is after 59 percent told us they had increased this allocation already in 2024—but plan to add to it again next year.

When it comes to hiring, 45 percent of CEOs said they plan to increase headcount in the next 12 months, vs. 46 percent in July—a slight decrease, though 62 percent of those who are currently hiring say they have seen improvements in their outcomes with the cooling of the labor market in recent weeks.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.