One of the most unfortunate side effects of the Covid-19 pandemic has been job loss or pay restructuring for millions of workers in almost every industry. But for savvy firms, it’s also creating an unparalleled opportunity to attract talented executives they wouldn’t otherwise have had.

Doing so successfully means having the right strategy in place, including a rewarding compensation program.

Unfortunately, when it comes to valuing, updating and communicating the benefits of executive compensation programs, there is a huge gap—largely based on size—in best practices among American companies. At a time when an increasing number of companies are turning their attention to the economic recovery, overlooking the value of compensation programs in winning the talent war represents a significant—and preventable—risk.

That’s one of the key findings of our 2020-21 CEO & Senior Executive Compensation Report for Private Companies, which this year includes a special bonus report on the impact the Covid pandemic has had on senior executive compensation programs. This year, Chief Executive Research surveyed more than 1,700 companies about their 2019 fiscal year compensation levels and practices and their expected 2020 compensation amid the crisis.

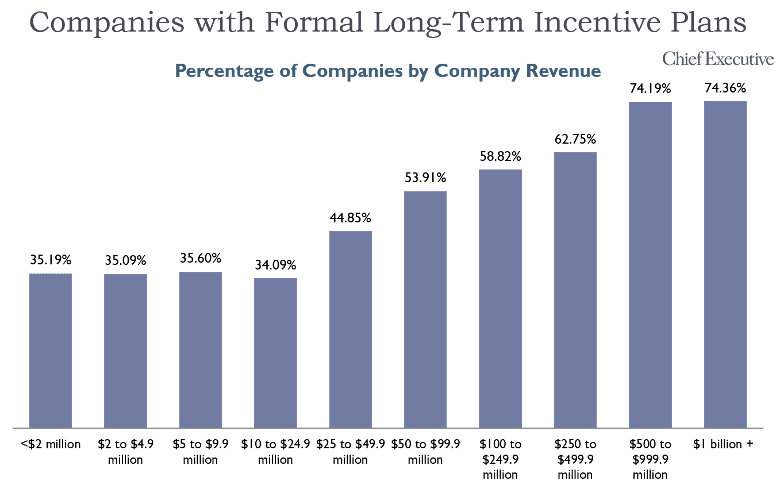

We found that while 74% of companies with a $1 billion+ in revenue had a formal long-term incentive plan with equity only 34% of companies with revenues in the $10 million to $24.9 million range had these kinds incentive plans in place in 2020—fewer than five years ago.

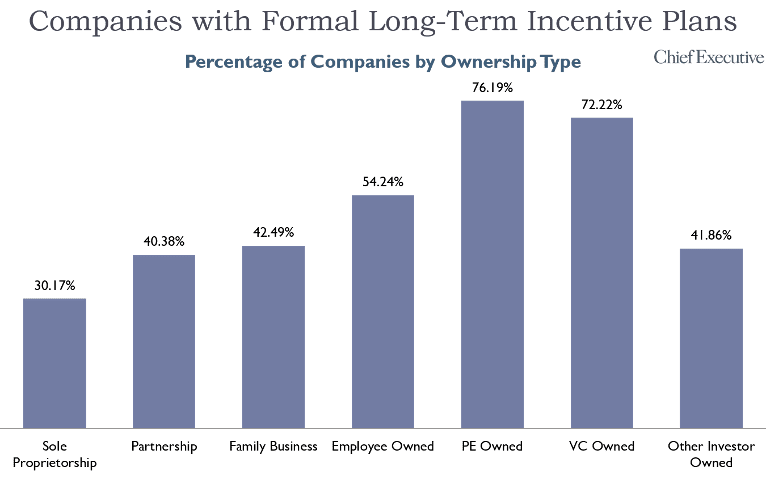

When you break it down by ownership type, there is another sharp divide: 76% of private-equity-owned companies, for instance, have a formal, annual incentive program vs. only 30% of sole proprietorships and 42% of family-owned businesses.

When you break it down by ownership type, there is another sharp divide: 76% of private-equity-owned companies, for instance, have a formal, annual incentive program vs. only 30% of sole proprietorships and 42% of family-owned businesses.

This represents a clear disadvantage for smaller companies competing for talent—or trying to retain talent. Even in small private companies that have some kind of long-term incentive program in place, far too often our research finds that they are informal and don’t get updated annually. This deprives the CEO of a powerful opportunity to rival the comp programs offered at public companies and bigger private companies.

This represents a clear disadvantage for smaller companies competing for talent—or trying to retain talent. Even in small private companies that have some kind of long-term incentive program in place, far too often our research finds that they are informal and don’t get updated annually. This deprives the CEO of a powerful opportunity to rival the comp programs offered at public companies and bigger private companies.

The problem is compounded when CEOs don’t communicate the value and progress of the program, leading executives to discount their value—making them potential flight risks or headhunting targets. The current environment is prime for such movements, and the situation is likely to heighten as the economy continues to mend.

If you’re a family business or someone who can’t offer long-term equity, what can you do? There are few ways to offer incentives without offering equity. Here are a few suggestions:

• Be more generous on salaries and long-term bonuses.

• Come up with long-term incentive program alternatives to equity, such as synthetic equity. In this case, you can approximate stock, a stock plan or an option plan.

• Mix in short and long-term bonuses plans based on performance.

The most important rule: Whatever you do, make sure your plan aligns with the long-term goals of the company. And make sure you’re loud and clear in communicating the value—whatever it is—to your team.

For more information on the findings of our 2020-21 senior executive compensation report for private companies, please visit CompReport.ChiefExecutive.net or write to [email protected].

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.