Compensation is one of the most strategic tools companies have at their disposal to attract top-notch talent, retain best performing executives and motivate the leadership team to achieve their objectives. In this era of near-record low unemployment and constant disruption, talent strategies are critical to success.

Compensation is one of the most strategic tools companies have at their disposal to attract top-notch talent, retain best performing executives and motivate the leadership team to achieve their objectives. In this era of near-record low unemployment and constant disruption, talent strategies are critical to success.

Yet, while most private companies spend a significant amount of money on executive compensation, they are not spending it optimally, according to Chief Executive’s annual compensation research of more than 1,500 companies.

Just Released: Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies. With data from over 1,600 private companies, it is the most authoritative resource in the U.S. for private company executive pay. Know more, pay smarter. Learn more.

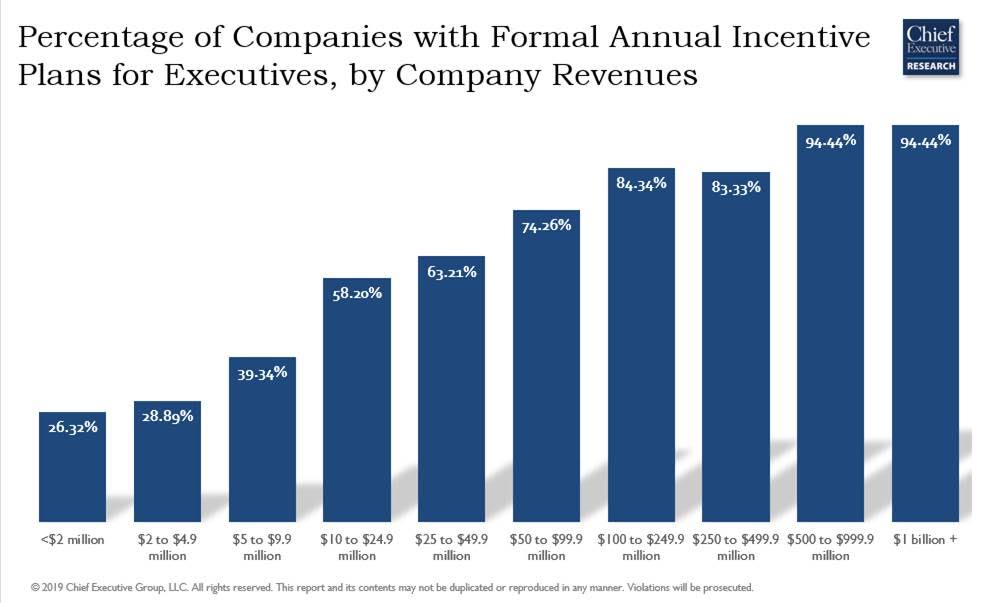

Just Released: Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies. With data from over 1,600 private companies, it is the most authoritative resource in the U.S. for private company executive pay. Know more, pay smarter. Learn more.For instance, while the best-performing companies use incentive-based compensation, 70 percent of companies with less than $50 million in revenues and 36 percent of companies with more than $100 million in revenues (which most would expect to be more “sophisticated”) still do not have formal long-term incentive plans.

Further, more than half of the private companies that participated in the study report not having their company value appraised at regular intervals, meaning their senior executives have no idea what their equity-linked incentives are truly worth.

Having robust compensation plans that account for the current and future environment and that understand the difference between motivating talent to deliver outstanding vs. average performance is crucial to gaining and maintaining a competitive edge. While median base salaries do not fluctuate significantly year over year, variable play and top-quartile numbers play a focal role in the talent acquisition-retention game, particularly for companies with more than $100 million in revenues.

The same is true of companies in certain industries, such as finance, real estate and biotech, where the bonus alone accounted for nearly half of the cash compensation in 2018 and, in some cases, is expected to surpass the base salary in 2019.

What to do if you’re a family business or someone who can’t offer long-term equity? A few suggestions:

• Be more generous on salaries and long-term bonuses.

• Come up with long-term incentive program alternatives to equity, such as synthetic equity. In this case, you can approximate stock, a stock plan or an option plan.

• Mix in short and long-term bonuses plans based on performance.

The most important rule: Whatever you do, make sure your plan aligns with the long-term goals of the company. And make sure you’re loud and clear in communicating the value—whatever it is—to your team.

More detailed information about compensation packages for CEOs and nine other senior executive positions, their base salaries, bonuses, equity grants and gains, benefits, perks and company compensation policies and practices, as well as how these elements vary by title, company size, industry, ownership type, geographic region and other key variables, is available in Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies.

For additional information about the report, contact Chief Executive’s research director, Melanie Nolen, at [email protected].

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.