The compensation survey is the Oracle of Delphi of the compensation world. Compensation wisdom seekers look at all of the reported data when trying to find a definitive answer to the perennial question: “What’s the right mix of pay?”

The compensation survey is the Oracle of Delphi of the compensation world. Compensation wisdom seekers look at all of the reported data when trying to find a definitive answer to the perennial question: “What’s the right mix of pay?”

Unfortunately, survey results do not provide categorical insights into the intricacies of executive compensation. Moreover, the amount of information may be overwhelming, especially if all of it isn’t applicable to all organizations.

Survey users, particularly those who seek insights into private company pay, need to rely on both the “science” and the “art” of data analytics.

The results of compensation surveys provide the numerical foundation — the science — behind pay determination. The art is the thoughtful interpretation of the data within the context of your organization, its values and its pay philosophy. Together, balancing science and art lead to the identification of the right amount to be paid through the right vehicles for your executive in a given role as performed within the realities of your organization.

In recent years, publicly traded companies have become less dependent upon compensation surveys. That’s because proxies and other SEC filings provide increasingly robust insights into the executive pay philosophy, pay levels, pay mix, pay delivery vehicles and other pay practices of the specific publicly traded companies that are the competition for executive talent.

Private companies, on the other hand, don’t have access to such competitor-specific pay data. As a result, they’re highly dependent on published survey data as a starting point for compensation decision-making.

Just Released: Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies. With data from over 1,600 private companies, it is the most authoritative resource in the U.S. for private company executive pay. Know more, pay smarter. Learn more.

Just Released: Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies. With data from over 1,600 private companies, it is the most authoritative resource in the U.S. for private company executive pay. Know more, pay smarter. Learn more.Private companies should proceed cautiously to understand and interpret the applicability of published survey data to the pay for their own executives. As a first step, keep in mind the basic reporting process underlying a compensation survey: all the reported individual data points for a particular pay component of a given role are lined up from lowest paid to highest paid. The bottom quartile (25th percentile), median (50th percentile) and top quartile (75th percentile) data points are reported as survey benchmark levels for each pay component. However, it may be difficult to see how the components of pay are related across these measures.

For example, the executive who receives the reported median base salary amount is most likely a different executive from the one who receives the reported median total cash. It is difficult to determine from the survey data results how those pay levels were derived let alone the applicability of the survey benchmark level within an individual company’s pay structure.

Questions to consider include:

At private companies, there is a high level of individuality and creativity in pay practices that a survey’s discrete data points do not capture. This, in fact, can be an advantage for private companies in recruiting and retaining executive talent. As I often tell my clients, there is no right or wrong answer inherent in survey data, but it does provide a very useful guide. However, the right answer is the one that makes sense within the context of your pay philosophy, culture and budgetary constraints.

As you begin a pay decision-making process influenced by salary survey data, consider the following cautionary notes as well as suggestions in italics for how to address them:

Compensation surveys represent the market value of the role, not the value of the person in your company fulfilling that role as defined by your company. For instance, your company’s president may have significant marketing responsibilities in addition to traditional presidential duties. Furthermore, in addition to differences in job content, the president’s role at your company might be filled by a high performer whose retention is critical to the success of the enterprise.

In such instances, compensation above the survey benchmark level may be warranted.

Compensation surveys represent how roles are valued at other companies, not at your company. Each company places higher or lower emphasis than the general market on its executive roles, based on its unique strategy and culture. For example, your COO may be the second most highly valued and paid role. At another similarly situated company, the CFO may occupy the second most highly valued and paid role. At a third surveyed company there may be little differentiation of pay among the key executives reporting to the CEO.

Individual executive pay determination should consider your company’s role value hierarchy.

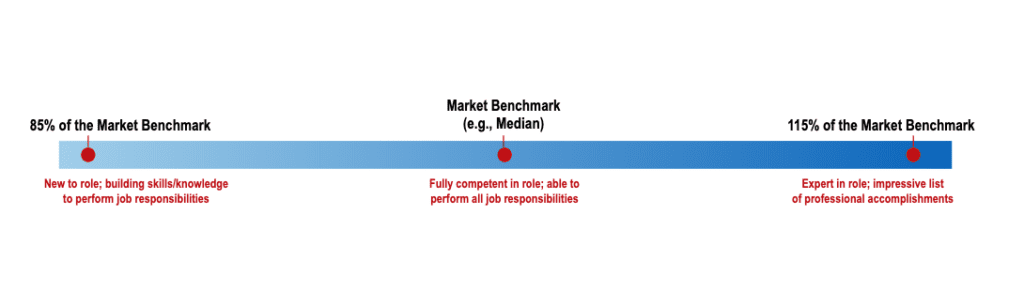

Compensation surveys don’t take into account the level of an individual’s experience in the role. The CSO at your company may be new to the role whereas the CSO at other similarly situated surveyed companies may be more seasoned.

Generally accepted practice is to consider +/- 15% of the survey benchmark value (e.g., median, top quartile) as a competitive range and then to place the executive’s pay within that range as illustrated below:

Compensation surveys don’t reflect the surveyed companies’ pay positioning and pay-mix philosophies. The pay positioning philosophy at your company might be to deliver total cash at the market median. To accomplish this, your company targets base salary and cash incentives at the market median. Another similarly situated company has a high-risk/high-reward philosophy, and it arrives at an overall median total-cash pay positioning with a pay mix that includes bottom quartile base salary and top quartile cash incentive opportunities.

Start with the total cash compensation survey benchmark level and then build the package consistent with your pay philosophy about how much risk to build into the package. (Note that it is common for private companies to have a different pay risk profile for each individual on the executive team.)

Many compensation surveys don’t capture the unique interplay between the current cash and long-term deferred cash/phantom ownership opportunities that commonly exist in privately held companies. For example, your company’s CFO may be a trusted advisor who has been with the company for many years, and his or her continued tenure is valued. You pay the CFO a base salary and annual incentive (bonus) on what might be considered the low side of fair. However, the CFO also has a long-term economic interest in the company that will pay out when he or she retires. In contrast, you compensate your high-performing but much shorter-tenured CTO in the top quartile for total cash but provide no long-term economic interest in the company.

Consider creating an inventory of the value of your long-term wealth accumulation opportunities by executive. Next, determine the total cash package (as described above). Then build into this total cash compensation package the long-term wealth accumulation opportunity that makes sense for your company. The long-term wealth accumulation opportunity should be consistent with the company’s pay philosophy, risk profile, how the role is valued and the expected long-term contribution expected from the person in the role.

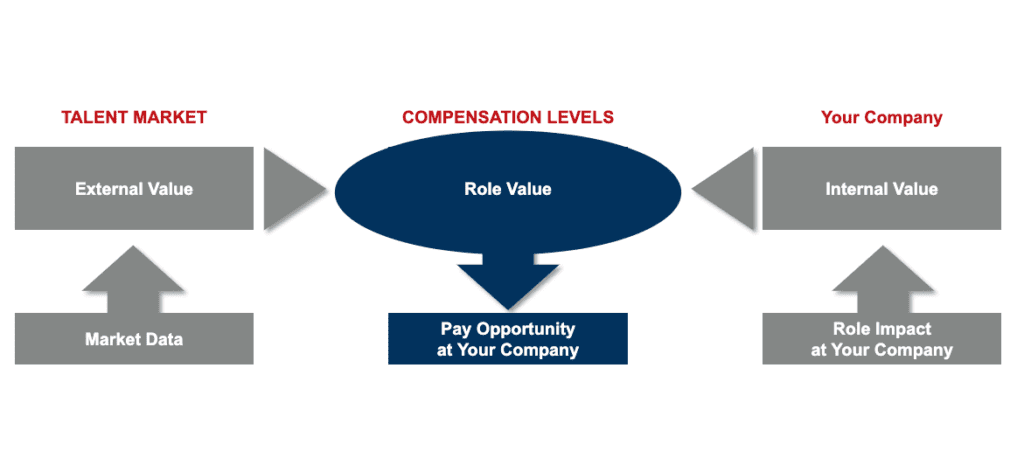

In your executive pay decision-making process, it is important to identify the appropriate balance between the external survey values and the internal value of the role. The framework below illustrates how external and internal values interplay in pay decision-making.

For private companies that are considering an update to their compensation practices, compensation surveys are a valuable starting point. First, understand and interpret their applicability to the pay for your executives. Then, broaden your approach. Many factors can or perhaps should be considered, such as organization pay and retention history, future direction and strategic plans, and marketplace competition.

To use a baseball analogy, the compensation survey data will get you to the right playing field and likely to the right section of the stands. Frequently, it may even help you find the right row. Rarely, however, will it guide you to a specific seat for a given executive. That seat needs to be the one with the best view of the game from the perspective of both the company and the executive.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.