Ram Charan: Your Inflation Is Not The CPI

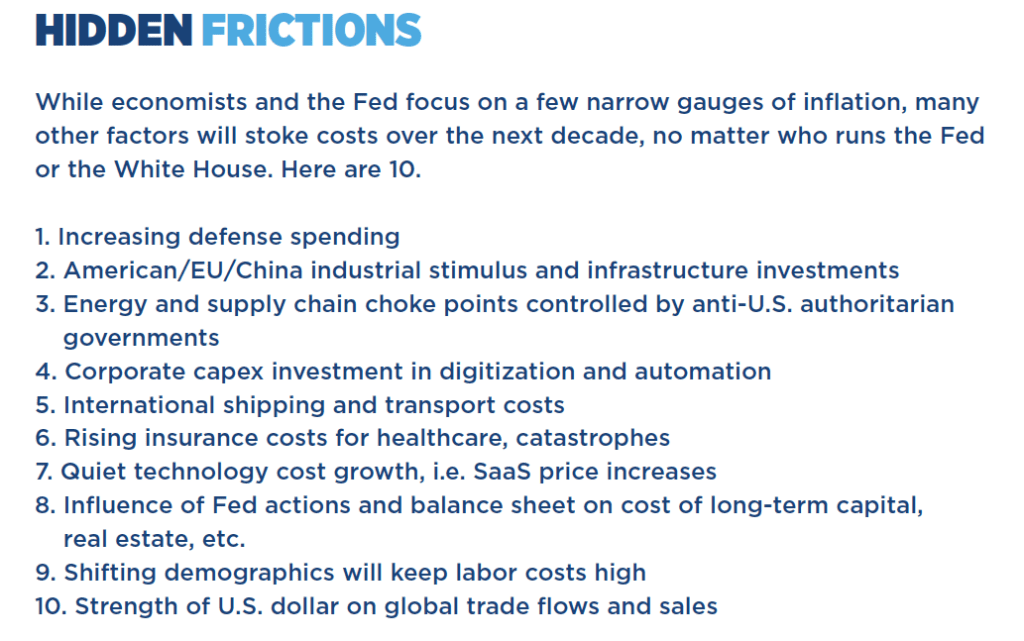

Inflation is here to stay, not merely as a temporary spike but as a persistent and deep-rooted element of our global economic landscape. We are currently experiencing what might metaphorically be described as the economy being “infused with cocaine.” This infusion is driven by several key factors—including geopolitical disorder and the machinations of powerful monopolistic players—driving rising costs that companies must factor into their five-year plans clearly and explicitly.

Let’s first understand the ‘why’ behind the imperative that every company think and plot rising costs over the next five-years and prepare accordingly. Take the example of a company that decides its costs will rise about 7 percent a year. Computed linearly, the five-year cumulative increase in costs is 35 percent—but compounded it equates to more than 40 percent. So, the question becomes, what should you be doing now to deal with that very likely future reality. Is it productivity initiatives? Launching a new product? Will you be able to command the prices to maintain margins? How will you manage cash flow? It triggers productivity lessons, new ideas for products, new structures, new ways of sourcing and rethinking capital allocations.

Next, consider the potential outcomes: Suppose forecasting a 7 percent increase inspires you to take actions, and your actual cost increase turns out to be 4 percent. That’s good news, and it puts you in a great position. If the increase turns out to be 9 percent, that’s bad news, but you’ll be in a far better position than companies who didn’t prepare for an increase.

The case for this action-oriented preparedness is clear: We are operating in an era characterized by unusual forces driving rising costs. First, we have seen accelerated defense expenditure globally, rising to $2.4 trillion from about $750 billion in 2000, with clear signals that it will continue to climb. This includes significant increases in the U.S., from $320 billion in 2000 to $876 billion in 2022, as well as other nations boosting their defense capabilities. Rising defense spending, driven by ongoing conflicts and geopolitical tensions, directly stimulates various sectors of the economy, especially where defense equipment and materials are produced and supplied.

Second, America’s shift towards a new industrial policy aimed at reducing dependency on China has led to massive subsidies in creating domestic industries. This policy covers critical sectors like semiconductors and other infrastructures, not only benefiting the U.S. but also its allies. The flow of investment into these areas, amounting to nearly a trillion dollars, will likely increase as tensions continue. This pattern is being mirrored not only in China, but also in the EU and elsewhere.

On the private enterprise front, substantial investments are being made in new factories, such as TSMC’s facility in Arizona, fueled by government largess. These investments—totaling more than $210 billion in 2023 alone, more than triple the annual rate in the 2010s, according to Census data—are creating a ripple effect across the economy, multiplying the impact on inflation. Changing demographics and labor scarcity will continue upward pressure on wages. Massive, ongoing investments in technology and automation upgrades will be continued contributors, too. Under a Trump presidency, imposition of tariffs will be another driver of rising input costs.

Most of us understand that the Consumer Price Index (CPI) does not fully reflect the actual inflation experienced by consumers. A visit to McDonald’s or Wendy’s—the places lower-income consumers take their families—underscores something we all know: real inflation is higher than CPI. Food and energy costs, significant portions of everyday spending, are escalating at rates not adequately captured by CPI measurements.

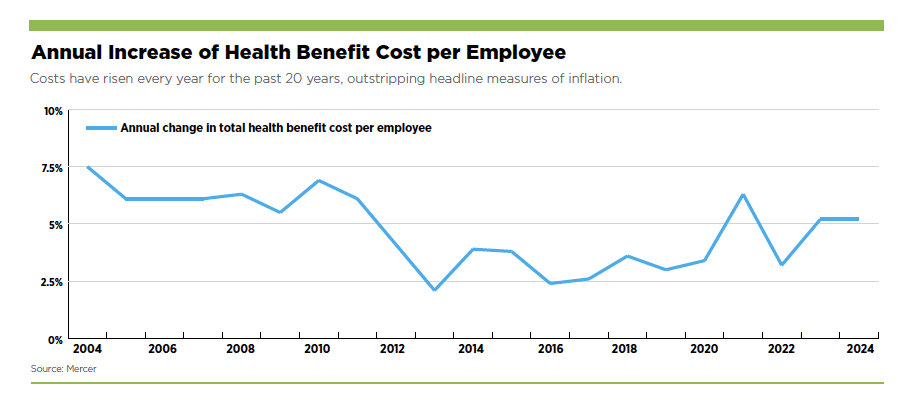

But for businesses, the pressure is even more underestimated and less well understood. Take insurance costs—particularly for employee healthcare. They remain a huge, long-term driver of cost growth for businesses in the U.S., with the cost per employee jumping 5.2 percent in 2023 alone (see chart below). Ditto for employers’ social security contributions.

Additional cost risk is growing across the global supply chain, where the pricing and availability of key commodities like energy and rare earths are controlled by dictatorial regimes. This control over supply and pricing extends to critical resources needed across industries, from pharmaceuticals to technology, with knock-on effects to all businesses. Price and availability have also been further compounded by the pirate activity and drought conditions in the Panama Canal.

Energy prices—which remain high and continue to influence sectors across the economy, from aluminum production to data centers—are another key driver of costs. According to the U.S. Bureau of Labor Statistics, the average cost per kilowatt hour went from $.084 in 2000 to $.173 in 2024, with little likelihood of slowing as consumption grows over the next decade.

The push toward automation and digitization is accelerating, necessitated by wage increases and the evolving demands of our economy. This investment is essential but also adds to inflationary pressures, especially as more technology is offered “as a service.” Remember when Microsoft’s ubiquitous Office product, for example, was available for $600 or less as a single purchase? Now costs—not including the latest AI upgrades—can exceed $22 a month per user, with automatic renewal. Adding additional features can drive that to well over $50 a month per user. There’s little chance costs like these will recede in the years to come.

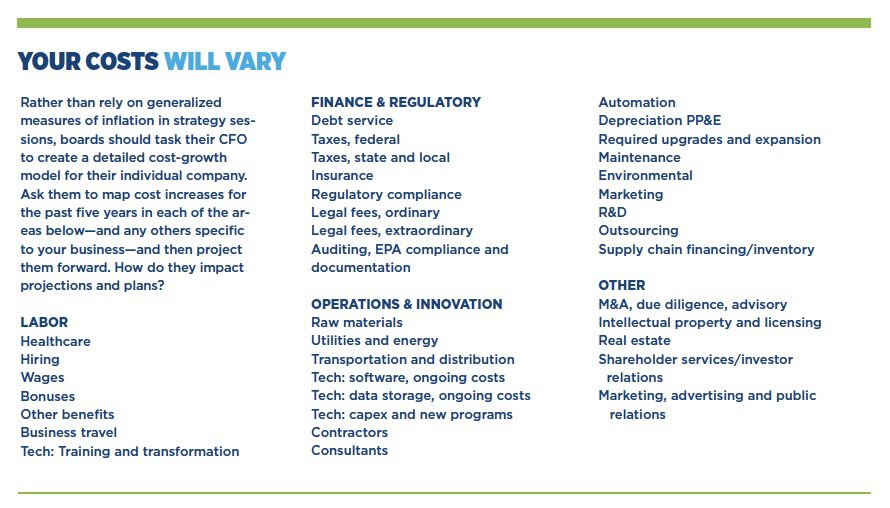

It is imperative that boards, CEOs and managers incorporate these insights into their strategic (five-year) planning. This involves mapping out the influence of each factor on their operations and preparing for continued cost increases through innovation in productivity and efficiency.

First, get a presentation from the CFO about external cost-driving factors for their industry and their business, including rising interest costs. Look back at the last five years—what patterns have they seen? Second, they should ask how these factors will be addressed in their five-year plans going forward? If past patterns hold, what will that mean to future costs and profitability? And third, what actions will management take this year to prepare for these changes? If the rising costs end up being lower than predicted, congratulations! Your shareholders will be thrilled—but better to be surprised by the upside than the downside. Here are some additional areas to ask management to tackle:

This phenomenon of hidden cost increases makes it imperative that companies give larger attention and focus to some major sources of inputs. This involves identifying every component of the cost—from raw materials, labor and energy to logistics, IT and digitization initiatives. Understanding where the costs are coming from is the first step in managing them. For instance, if a significant portion of your cost is tied to commodities that are sensitive to geopolitical tensions, consider strategies for hedging against price volatility.

Maintain open lines of communication with all stakeholders. Internally, get people prepared by making them understand what is coming and ensuring their psyches are attuned to this new environment. This messaging will also shape investor calls so that the company doesn’t lose credibility when surprises come.

It puts enormous pressure on a company when prices are rising in a context where supply chain availability is controlled by dictators or influenced by natural causes like the drought in Panama Canal or by the pirates on the sea.

In an environment of huge uncertainty, rising costs and inflation chewing cash, you must watch your debt ratio. Enormous short-tem debt can be fatal.

This will be the most difficult task. The HR organization will need to develop new ideas regarding compensation, retention and having the right people in the right jobs with the right mental mindset.

The strategies outlined above require a proactive and flexible approach to management. Businesses that anticipate changes and adapt swiftly to the new realities of a high-cost environment will not only survive but thrive, turning challenges into opportunities for growth and innovation.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.