CEO Confidence Rises In May Poll On Fed Hopes

If the past week’s market rally didn’t make it clear, our May CEO Confidence Index poll confirms it: America’s business chiefs are seeing good things on the horizon. And by horizon, we mean post-election.

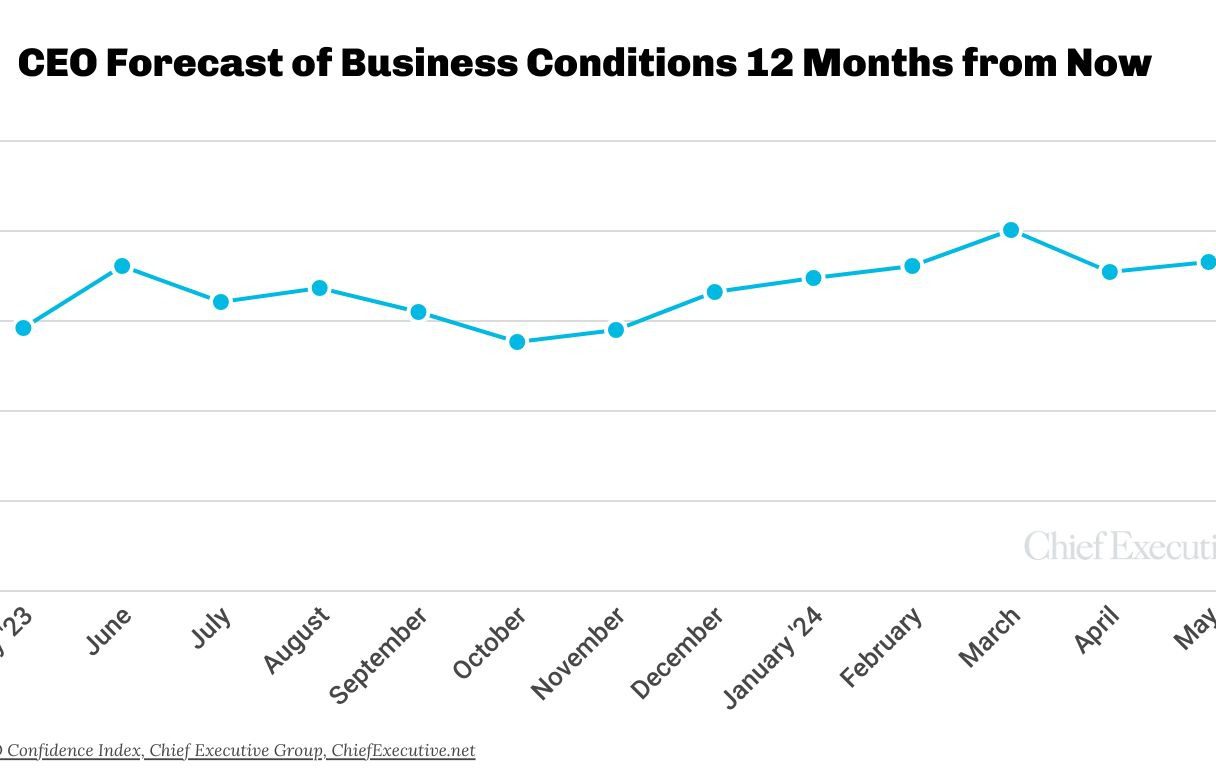

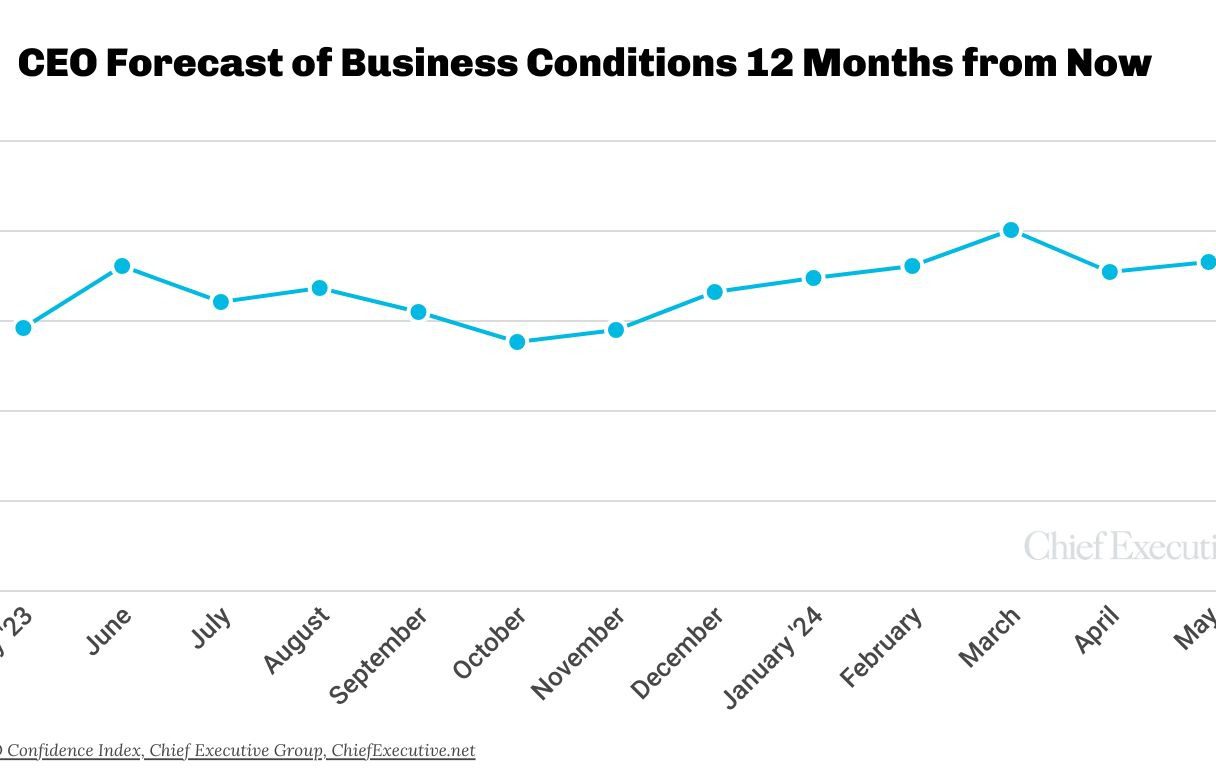

After a slump in April, when our forward-looking indicator tumbled nearly 7 percent due to Fed wavering about its next move, the most recent data collected from the 156 CEOs we polled May 7-8 shows an improvement in 12-month forecasts.

Our Index, which measures CEOs’ confidence in business conditions 12 months out, is now at 6.7 on a 10-point scale where 1 is Poor and 10 is Excellent, up 2 percent from 6.5 in April—and the second highest reading of the year so far, up 4 percent from where we started 2024.

Economic factors such as cooling inflation data, GDP growth and softening in the labor market are the main drivers behind this uptick, they say, alongside expectations that the Fed will cut rates at least once before the year is over. Some 51 percent anticipate a cut, among which 6 percent believe there will be more than one.

“It sounds like the Fed is going to lower interest rates, and the labor market could cool just slightly,” said Danny Gutknecht, CEO of Pathways.io, who forecasts conditions to improve from a 7 out of 10 today to a 9/10 by this time next year.

“We are seeing the Fed’s efforts beginning to take effect and the economy is slowing. Business will eventually benefit from a stabilization of inflationary issues,” said Michael Uffner, president and CEO of Auto Team Delaware, though he does not expect a rate cut this year.

Politics was also cited several times by those polled, with the majority saying the pre-election turmoil will have quieted by this time next year, which will tame uncertainty in the markets.

“The Fed will eventually bring inflation closer to 2 percent, and the uncertainty of the elections will be over in the next 6-7 months,” said Edward Gerner, president of Maryland-based insurance agency R.K. Tongue Co, echoing many others who believe getting past the elections will taper volatility and set the tone for business, regardless of who wins.

For now, however, CEOs continue to view current business environment as challenging, at best. When asked to rate them on that same 10-point scale, they gave an average of 6.2, down 2 percent since April and the lowest level of the year.

Overall, 49 percent of the CEOs we polled said they expect business conditions to improve over the next 12 months, up 5 points from 44 percent last month. Only 22 percent forecast a deterioration post-election—and 29 percent said they anticipate more of the same for some time still.

Against this backdrop, 71 percent of CEOs participating in the poll said they expect an increase in revenue over the coming year—up from 69 percent in April but still below the 75 percent proportion we found when we polled them in early January.

Among those forecasting revenue growth, our survey found a shift toward smaller increases compared to prior months. For instance, 18 percent expect revenue to grow by 20 percent or more, vs. 13 percent who said the same in April and 18 percent in March. Instead, 37 percent said, in May, that revenue should increase by less than 10 percent.

When asked to forecast profitability, 63 percent said they expect their company’s profits to rise—unchanged since April but down 3 percentage points since January (66 percent). Like revenue growth, the range by which these CEOs expect profits to rise is also shrinking.

Another area where the data shows a pullback is in the proportion expecting to increase hiring in the 12 months ahead: 40 percent in May, down from 44 percent in April and from 56 percent earlier this year. Only 18 percent are planning cuts, however; the others are, instead, keeping staffing levels unchanged for the time being.

Finally, the proportion of CEOs planning to increase capital expenditures is up since April, at 45 percent vs. 41 percent—and exceeding the proportion who said the same at the start of the year (43 percent). CEOs say interest rates have little to do with their decision—and less than a third said they had delayed most or all of their large investments in anticipation of rates coming down.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. See additional information about the Index and prior months data.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.