CEO Confidence Index: Brace for Recession?

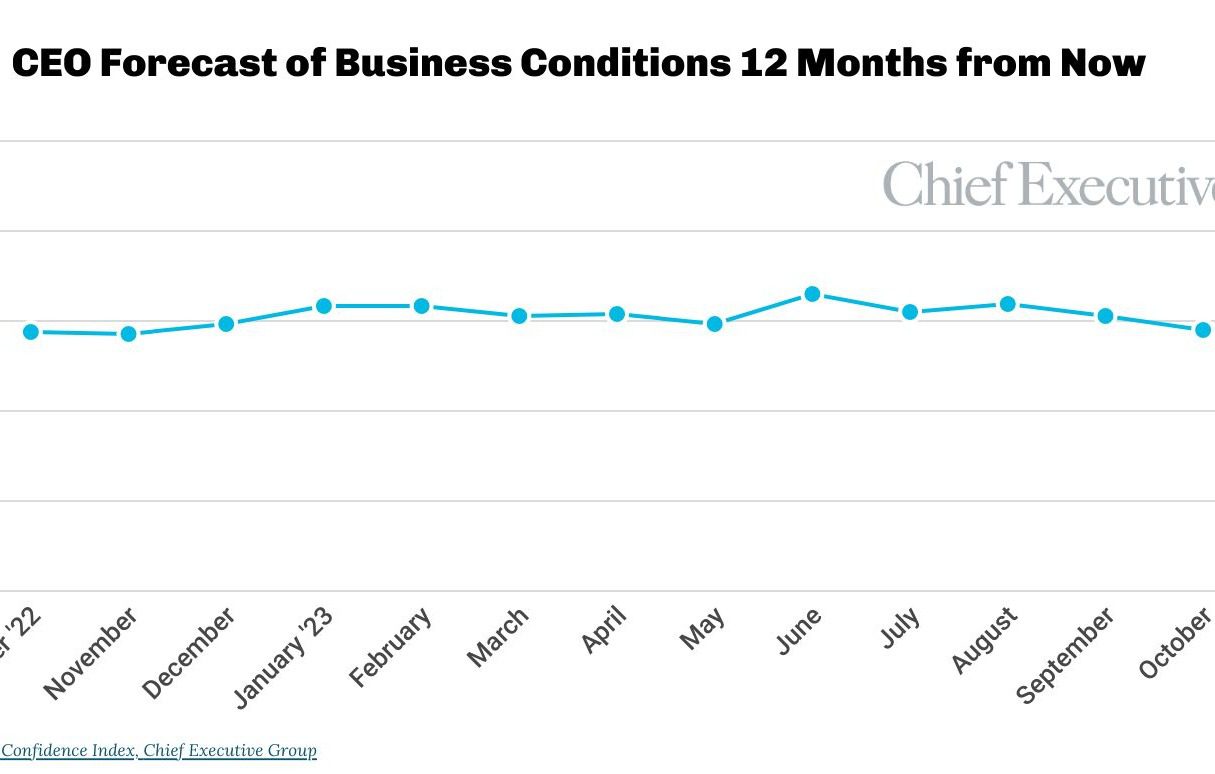

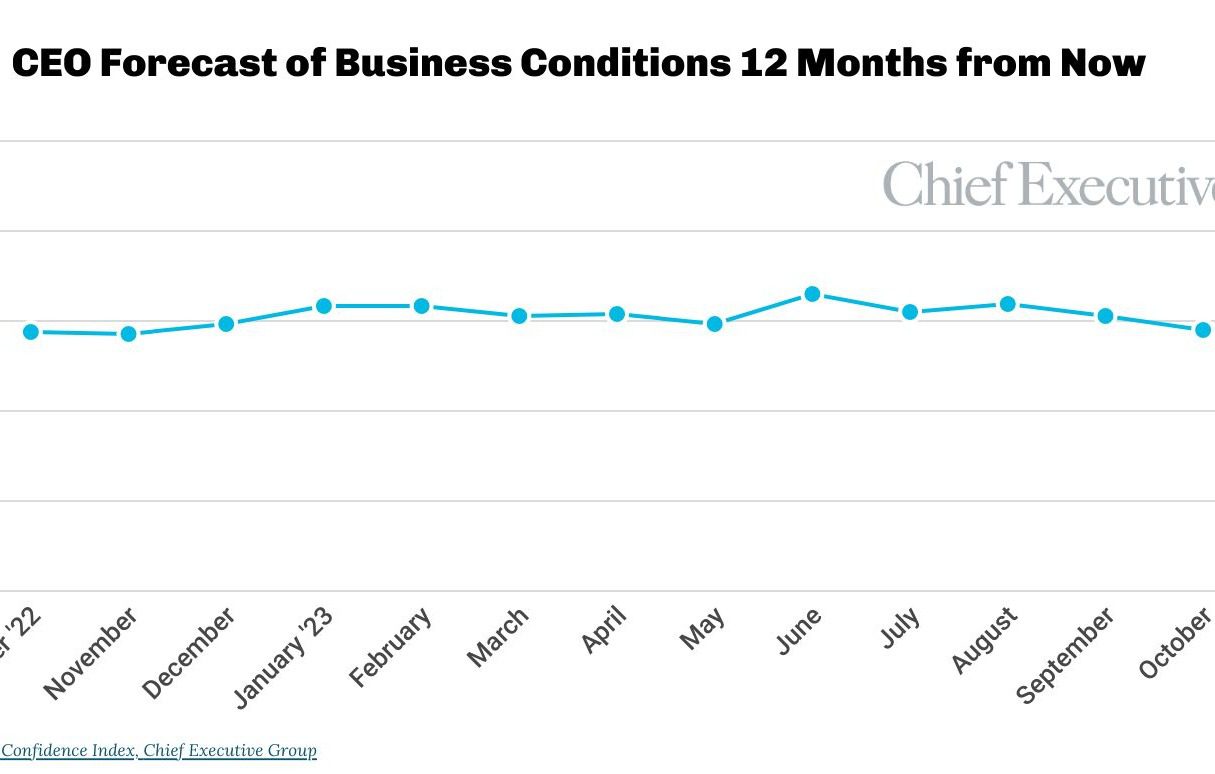

It looked hopeful for a while. Just four months ago, in June, optimism among the CEOs we polled that month was on the rise after a year in the doldrums, as the Fed paused on rate hikes, Congress avoided a government shutdown and economic data came in better than expected.

This fall, it’s a different story, with CEOs once again downgrading forecasts and abandoning the idea of a strong economic recovery any time soon.

According to our October CEO Confidence Index, which surveys U.S. CEOs on their forecasts for business conditions in the year ahead, the majority of the 240 CEOs we polled October 3-5 believe the risk of a recession unfolding in 2024 is high. Overall, nine CEOs out of 10 said they expect economic conditions in 2024 to either be flat (30 percent) or negative (58 percent).

Asked to assign a rating, on a 10-point scale where 10 is Excellent and 1 is Poor, for the business conditions they expect to see by this time next year, their number dropped to 5.8, from 6.1 in September and 6.4 in August. That is a 5 percent drop in one month, and a 12 percent drop since June, when their rating topped 6.6—at the time the highest level in over a year.

“A recession will happen in 2024. Interest rates and other factors are stacked too high against further expansion,” said Jim Nelson, president and CEO of Parr Instrument Company.

While he expects that to affect revenue and profit growth, like most of the CEOs surveyed, he nevertheless anticipates the recession to be mild.

“The macroeconomic is still very uncertain, but all of the recession talk is beginning to sound like the boy who cried wolf,” said the CEO of a software company. “The Fed has done a good job to this point, and I believe any recession will be very mild if there is one at all.”

“I think we will see some weakening globally as higher interest rates, higher energy prices and the continuing upward trend in compensation all have negative impacts on earnings. At this point, I am not sure if inflation or recession will rule the day,” said the CEO of a chemicals manufacturer.

When asked to assess the current business environment, CEOs also downgraded their rating, to a 5.9, shaving 3 percent off their August rating—and 12 percent off their June optimism. The consensus seems to be that demand is slowing across sectors, and operational costs along with wage pressures are adding to the challenge of finding growth opportunities.

“Consumer costs (real, CPI, interest, credit card %, etc.) are too high to see sustained retail and manufacturing growth or even 2023 maintenance levels—let alone the chaos of our own government, international platform, etc.,” said the CEO of a consumer manufacturing company who views the current environment as “weak”—or 4 out of 10. “I expect it will be the tail of 2024 to see ‘good’ conditions again.”

Overall, two-thirds of the CEOs polled expect conditions to remain difficult in the year ahead—37 percent of which said they project that things will get even worse before they get better. That number is up five percentage points since September—and the highest we’ve seen since March, amid the bank crisis.

Expectations of a slowdown or recession in 2024 are, as one could expect, hitting profit forecasts for the year. The proportion of CEOs expecting profits to increase in the 12 months ahead dropped to 56 percent, from 62 percent last month. Overall, more than one quarter said they anticipate stalling profits in 2024, when compared with year prior.

Revenue forecasts are also down, though to a smaller degree, with 68 percent forecasting revenue growth in 2024, vs. a third who anticipate either flat or negative growth. While those numbers are similar to what they were in the first quarter of the year, they are down from the previous quarter.

Unsurprisingly, these gloomy forecasts are also impacting plans to hire and capital expenditures. September data shows 37 and 36 percent, respectively, planning to increase hiring and capex in 2024, vs. 43 and 47 percent in August.

We’re seeing significant variations in CEO confidence and forecasts by sector in this month’s poll. Among those finding the current environment most challenging are retail, real estate and consumer manufacturing CEOs, who all gave ratings double digits below the average, while peers in the pharma, government/nonprofit, telecommunications and construction/engineering sectors all outperformed the average by similar margins.

Most pessimistic about the 2024 landscape are real estate, transportation and travel/leisure CEOs—three sectors where at least three-quarters of CEOs expect a mild to severe recession in the year ahead.

At the other end of the spectrum—and well ahead of any other group—are pharmaceutical CEOs, two-thirds of which expect a recovery in 2024. Pharma CEOs also projected the highest rating for business conditions by this time next year, 8.2/10—that’s 40 percent higher than the 5.8 average.

Looking ahead at 2024, retail, transportation and travel and leisure CEOs all expect the climate to be weaker than the average rating of 5.8, while pharma CEOs stand out as, by far, most optimistic, with a forecast of 8.2 out of 10—41 percent above the average.

An even more compelling analysis for the sector variations is looking at CEOs’ rating of current conditions and what the change they expect one year from now—what we refer to as optimism. With that lens, we can see the expected improvement or deterioration in business conditions that CEOs expect by this time next year, as shown on the chart below.

Similarly, recession forecasts—and the extent of a recession should there be one—also varies considerably by sector, as shown below.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.