CEO Confidence Slips In March As Fed Chair Talks Down Expectations

Well, it was fun while it lasted.

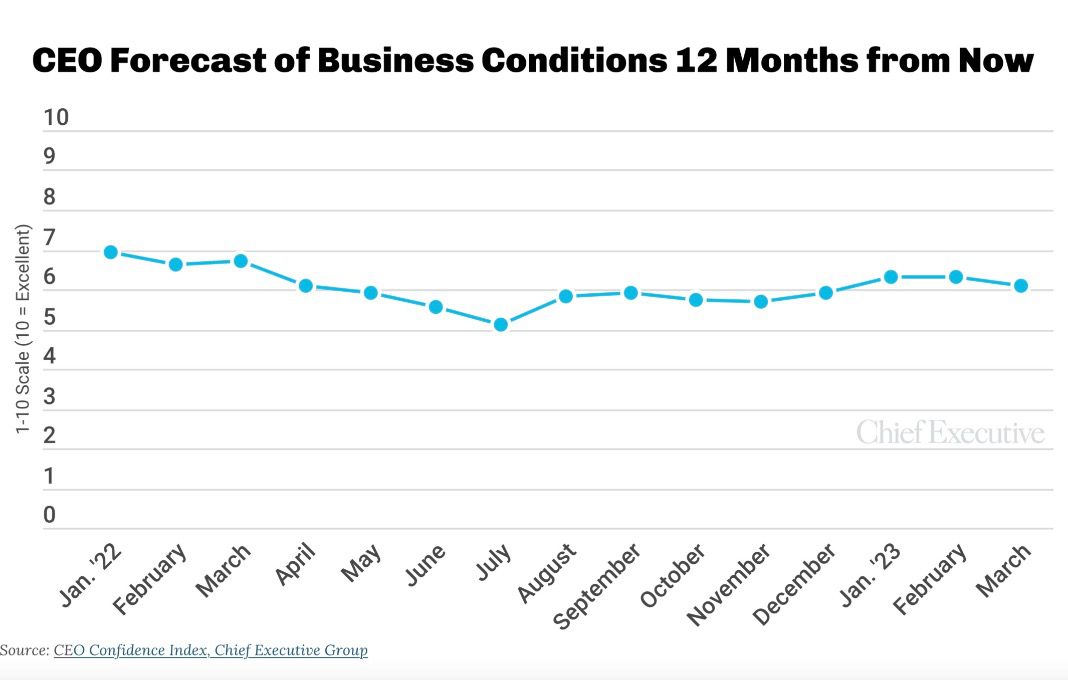

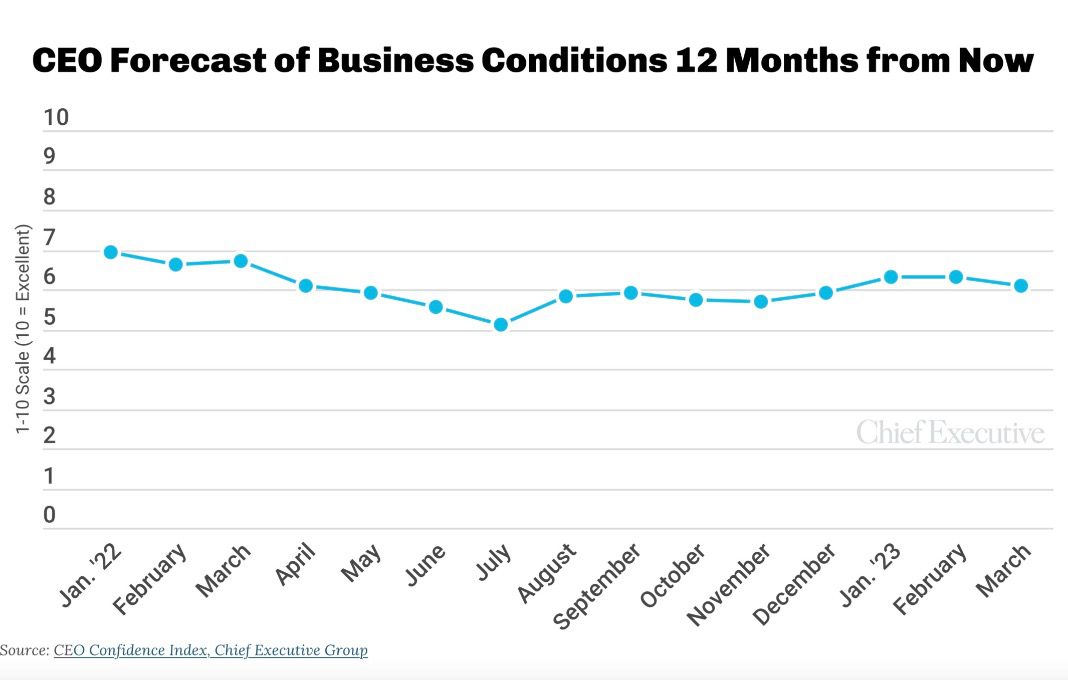

A multi-month streak of increasingly optimistic reads on the future of the economy snapped in March, as CEOs grow increasingly convinced demand and consumer spending will cool amid continued Fed rate hikes, leading to a recession. What’s still unclear: when it will happen and how long it will last.

The turn in sentiment closely tracks the timing of remarks to Congress by Federal Reserve Chairman Jay Powell, who annunciated once again that the central bank was finding inflation more stubborn to control than expected, and the Fed would do what it felt it needed to do to reign it in.

For the majority of the 177 U.S. CEOs Chief Executive polled March 7-9 as part of our monthly Confidence Index, Powell’s aggressive signaling on interest rates was more than enough to dampen expectations. Other issues aren’t helping: concerns over the debt ceiling, regulations, continued rising costs—especially wages—in a continually challenging labor market were all listed as reasons for reduced optimism.

The Index—which asks CEOs to predict business conditions 12 months from now—slipped to 6.1 out of 10 on our scale (1=poor and 10=excellent), down 4 percent from last month, as an increasing proportion of CEOs are now expecting conditions to worsen over the course of the year. CEOs’ confidence in current business conditions remains unchanged at 6.2 out of 10, with many chiefs sharing that they have yet to see indications of a recession on the consumer side—other than interest rate hikes.

“Pipeline activity is good but decisions to move ahead on projects are stalled across the board. Businesses do not like uncertainty,” says Daryl Travis, CEO at Brandtrust, a communications and advertising firm. He rates both current and future conditions as ‘weak’ or 4 out of 10 on our scale, sharing that he has seen a decrease in demand since last year at this time and expects the trend to continue.

The CEO of a billion-dollar travel/transportation company agrees: “Corporate and consumer spending for discretionary items has still not returned to pre-pandemic levels. Wage inflation continues to grow and extend.” He matches Travis’ rating of future conditions at a 4 out of 10, down from the 5 he rates current conditions.

They are part of the over one-third of CEOs who say that demand is down today from this time last year and the 26 percent who also expect demand to drop in the year ahead. Both proportions are virtually unchanged from last month.

Even the 45 percent of CEOs who say demand is up since last year join in voicing their continued struggles with the labor market. Patrick Collings, President at Lane Enterprises Holdings, Inc., a large industrial manufacturer, is one of them. His forecast of worsening business conditions is due to “Rising interest rates and continuing labor challenges from rising wages and a lack of qualified labor”.

Jim Nelson, CEO and President of Parr Instrument company agrees that rising interest rates will have some effect. “The federal reserve will overshoot with interest rate policy, and we will see a recession of some magnitude,” he says. He expects future business conditions will drop from 10 out of 10 currently to 8 out of 10 in the future. “Demand will cool going into 2024.”

Inflation and interest rates are the main reasons why 38 percent of CEOs expect business conditions to worsen, now a larger proportion than those who expect conditions to improve or remain unchanged. Still, 34 percent of CEOs expect conditions to improve further, despite current headwinds and maintain predictions that the recession will be mild and short-lived.

“I believe the economy is moving to a flatter line than ever before recorded. More consistent and moderated growth on a smaller incline,” says Christine Nichols, CEO at People Science, a talent acquisition outsourcing and consulting firm. She expects business conditions to steadily improve, rating current conditions at a 6 out of 10, slightly below her 7-out-of-10 outlook for the future.

David Enlo, CEO at Societal CDMO, a large pharmaceutical company, agrees. “Companies are settling in a bit more to the new normal. Lots of decisions that were tabled until things settled down will have to be made soon. This will drive activity and therefore commerce.”

A smaller proportion of CEOs are now forecasting rising revenues, down to 69 percent from 70 percent the month prior. However, they are not discouraged by their profits, with 5 percent more CEOs projecting increases this month compared to last month, at 59 percent.

Still, CEOs remain wary of upping their headcount in the year to come, with 47 percent of CEOs indicating that they will increase hiring, down 2 percent from February.

The proportion of CEOs planning increases to their capex is down over 20 percent in March, with only 41 percent of them planning increases.

“As CEOs, it’s our job to navigate the economic storms. Just riding out the storm may not be the answer. Sometimes, you need to adjust your sails and sail into the storm, to emerge to the clear waters on the other side. Build up a fortress of capital now to take on the economic storms coming at us,” says Steven Leafgreen, CEO at Western Vista FCU.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.