CEO Optimism Climbs to Multi-Year High In February

America’s CEOs are increasingly convinced that the Covid crisis — which has crushed the global economy, bloated the nation’s balance sheet will trillions of dollars in new debt, destroyed the livelihoods of millions of citizens and killed more Americans than WWII — will soon come to an end.

In Chief Executive’s latest poll of more than 300 U.S. CEOs, fielded from February 2-4, those surveyed rated their confidence in future business conditions at 7.1/10 on average — a 2-year high — and a growing number of business leaders now forecast growth in revenues and capital expenditures as well. Meanwhile, they rated their confidence in current business conditions “good,” at 6.2 out of 10 on our 1-10 scale (+1 percent since January).

“Covid should hopefully be mostly behind us,” says the CEO of a healthcare finance company to explain his forecast of business conditions 12 months from now. “We work with healthcare providers and expect them to see a rebound in people getting services that they put off during Covid.”

“The virus vaccine is giving hope that as the year continues, business will improve for most industries,” says Greg Peay, president of Bradsby Group, an executive recruiting agency based in Colorado.

Not all CEOs agree. More than a third of survey participants responded with varying degrees of concerns over what comes next. Some believe that rising inflation and stimulus packages will put the U.S. economy at risk of a recession; others say less business-friendly public policies could impede the recovery; and others observe that there is still hesitation from their customers to move forward with projects until more clarity is achieved.

“Covid still [orders] some major uncertainties, as does the government transition,” says Norman Wolfe, CEO of Washington-based consultancy Quantum Leaders, although he is hopeful that “within six months, things will begin to sort out and a clear vision of what the future will look like will unfold.”

Mark Cohen, the CEO of Ntelicor, an IT staffing & recruiting agency in Dallas, Texas, says “I’m 100% uncertain about our political leadership and the impact of printing trillions of dollars, increasing taxes, etc. Will there be a systemic collapse despite today’s perceived growth and high-cap market valuations?”

Quentin L. Messer, Jr., president and CEO of the New Orleans Business Alliance, says he anticipates that by “this time in 2022, we should be on the backside of the pandemic,” but he doesn’t expect business conditions to rank higher than a 6 out of 10: “The challenges with the vaccine rollout will delay large-scale immunity, which we delay a return to large conferences, festivals and business travel,” he says, adding that “not all of the jobs lost will return, which will put downward pressure on customer spending, which powers a lot of the U.S. economy.”

For those reasons—and others—38 percent of the CEOs surveyed showed either caution or pessimism in their outlook, expecting business conditions a year from now to be either unchanged from today or worse—at 23 and 15 percent, respectively.

The Year Ahead

While the proportion of CEOs expecting an increase in profitability remains unchanged since last month, at 72 percent, the number of those expecting growing revenues, capital expenditures and headcount is up 4, 5 and 7 percent, respectively—at 78 percent, the proportion of CEOs forecasting increasing revenues is now at its highest level since April of 2019.

Similarly, the proportion of CEOs planning to add to their workforce in the year ahead has reached a level unseen since September 2018, further demonstrating growing confidence in the recovery among CEOs. It is up over 7 percent since last month.

The proportion of CEOs planning to increase capex (50 percent) has now rebounded from its Covid-related losses to the value seen at this time a year ago.

Sector & Size View

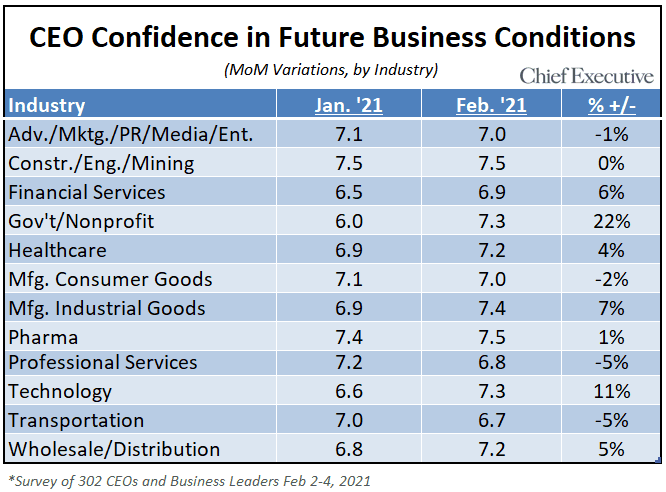

February data shows stabilization in most of the industries that decreased last month and no significant downturns. After a sharp decline last month, the Government/Nonprofit and Wholesale/Distribution sectors have now bounced back to their December levels.

On a year-over-year basis, the majority of CEOs across all sectors is forecasting “good” to “very good” business conditions by next February.

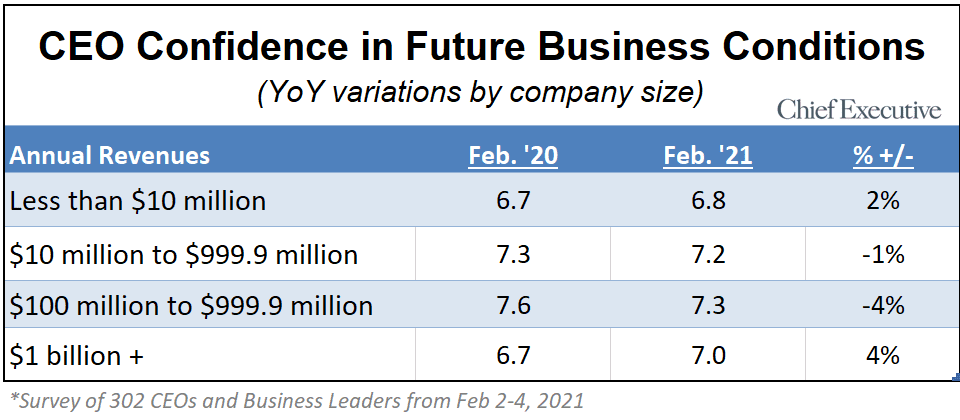

Confidence levels by company size are up across the board in February, with companies with more than $1 billion in revenue experiencing the largest month-over-month increases.

Looking at the data year over year, all cohorts seem to have more or less the same level of confidence they did at this time last year, expect for the mid-sized revenue group.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.