CEO Confidence Continues To Climb In January

A new poll—taken amid the Georgia Senate runoffs and the violence surrounding Congress’s confirmation of the election results—finds growing CEO optimism, with an ever-larger number of chief executives predicting solid growth for their companies, and for the nation as a whole.

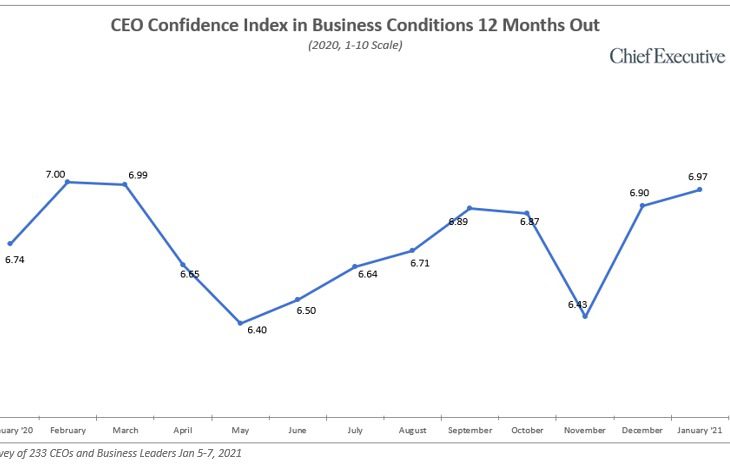

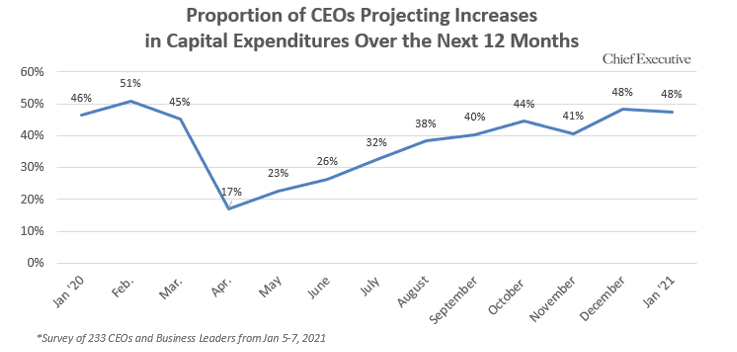

While many of the 233 U.S. CEOs Chief Executive polled from January 5-7, 2021 said there were obvious challenges ahead, confidence in the current business environment edged up another 2 percent in January, to 6.2/10 from December. CEOs’ outlook for the business environment 12 months from now is also strong, at 7/10, essentially flat from December but up 9 percent since the bottom of the Covid crisis last spring.

“Hopefully, [with] post wide-scale vaccination, we can begin to emerge in a new ‘pandemic-era’ normal,” says Quentin L Messer, Jr., president and CEO of the New Orleans Business Alliance, echoing the sentiment of many other CEOs.

Several business leaders participating in the January poll also attributed their optimism to the technology advances companies have made in recent months—and how these innovations are paving the way to a new economy.

“Technology advances will yield new consumer-brand engagement opportunities,” says Carl Fremont, CEO of PR and brand marketing agency Quigley-Simpson, who forecasts conditions one year from now to be a 7 on our 10-point scale.

“Digital transformation and services have and will continue to save the overall economy,” says Craig Cooke of Rhythm Agency, who expects his profits and revenues to be up over 20 percent by this time next year.

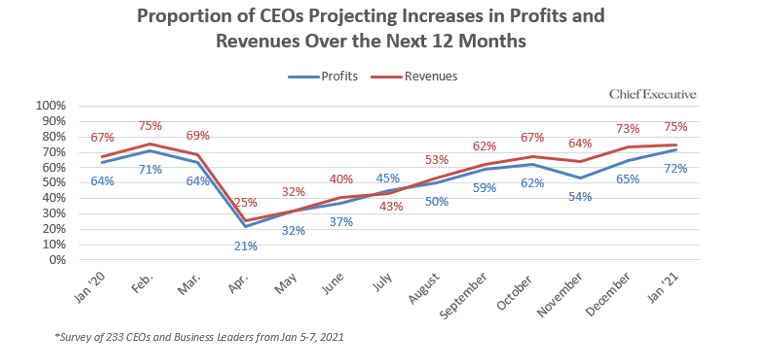

An increasing number of CEOs are expecting 2021 to be a year of growth, with 72 and 75 percent anticipating increases in profits and revenues, respectively, compared to 65 and 73 percent the month prior. This is 13 and 11 percent more CEOs forecasting growth than this time last year, when strong consumer sentiment, high job creation, continued deregulation and low interest rates fueled optimism—and the largest proportion forecasting increases in profits we’ve observed in almost two years.

“I worry that CEOs remain too cautious about 2021,” says Tom Doorley, chairman of Sage Partners. “I don’t see enough investment or risk taking.” Nevertheless, he believes future business conditions will be “very good” but cautions that “it will be slow recovery much like 2008 if companies stay hunkered down for too long.”

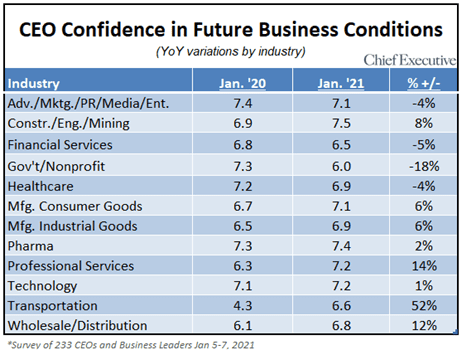

January data shows a change from last month—four industries’ forecasts for future conditions decreased. CEOs in the Gov’t/Nonprofit and Wholesale/Distribution sectors reported the greatest declines in confidence for the future, down 19 and 17 percent since last month, respectively. They cite a lack of confidence in the government to act swiftly and efficiently in containing Covid-19 and fears of a Democratic congress’ policy initiatives as grounds for their outlook.

Most sectors, however, remain optimistic that 2021 business conditions will improve. The end of Covid mandates is the most cited reason for this optimism across industries. Sentiments about the new administration are split across industries, with some believing that political stability and predictability will improve business conditions enough to outweigh regulatory concerns, and others who believe the new administration will stifle growth and restrict freedom.

On a year-over-year basis, Transportation and Professional Services CEOs report the largest increases in optimism, and are among the most confident that business conditions 12 months from now will be “very good.”

Overall, CEOs across all sectors continue to forecast “good” to “very good” business conditions by December this year.

Nevertheless, looking at the data year over year, all cohorts are now more optimistic than they were at this time in 2020, before the Covid-19 pandemic was made known in the U.S.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.