This is the second in a series on executive compensation, based on findings from our exclusive 2019-20 CEO & Senior Executive Compensation Report for Private Companies, which gathers data from more than 1,600 private companies. It is the most authoritative resource in the U.S. for private company executive pay. Part 1 is here.

With an unemployment level near 50-year lows, having a robust talent strategy is a must, and a core element of this strategy is competitive pay. It is imperative for companies looking to retain their best talent to offer a compensation plan that is not only competitive but also rewarding and motivating.

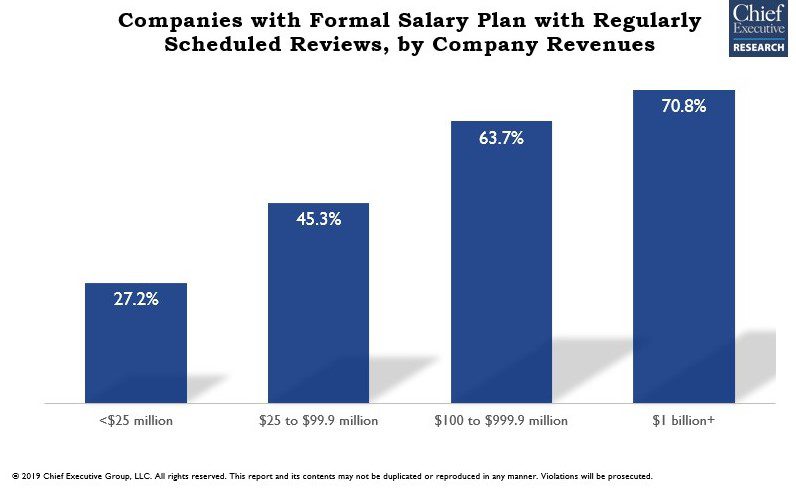

Yet, more than half of small and lower-middle-market companies (annual revenues less than $100 million) don’t have a formal salary plan with regularly scheduled reviews—a component of a compensation plan that provides incentive and, thus, motivation to employees to achieve their objectives and continue to develop the skills that will enable them to grow both inside and outside the company. That’s one of the key findings of our most recent CEO & Senior Executive Compensation Report for Private Companies, for which Chief Executive Research surveyed more than 1,600 private companies from April through June of 2019 about their 2018 fiscal year and expected 2019 compensation levels and practices.

Just Released: Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies. With data from over 1,600 private companies, it is the most authoritative resource in the U.S. for private company executive pay. Know more, pay smarter. Learn more.

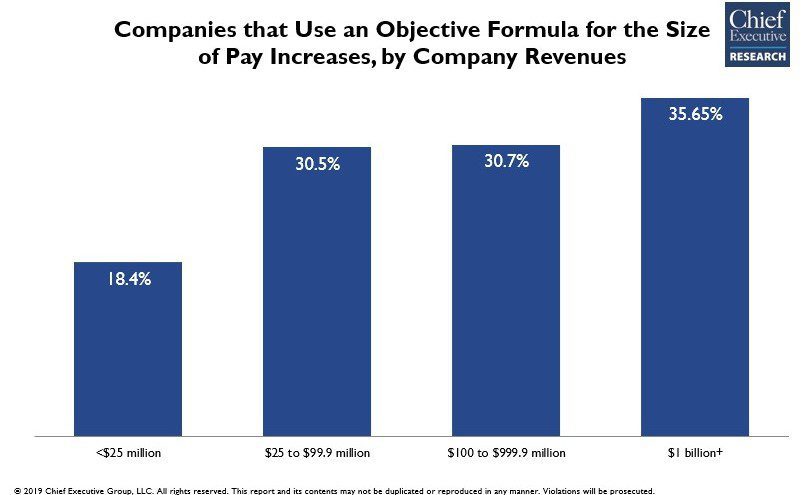

Just Released: Chief Executive’s 2019-20 CEO & Senior Executive Compensation Report for Private Companies. With data from over 1,600 private companies, it is the most authoritative resource in the U.S. for private company executive pay. Know more, pay smarter. Learn more.What’s more, less than 30 percent of companies, across all sizes, use an objective formula to determine the size of pay increases, and that number drops to 18 percent for the smallest companies (less than $25 million in annual revenues).

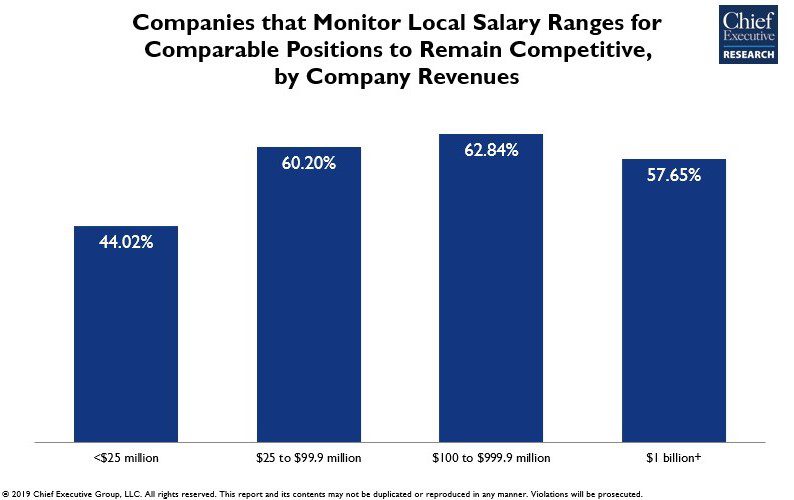

This lack of formal metrics can be a deterrent to some employees, who may find that the company isn’t sufficiently invested in rewarding their performance or promoting career growth. Rather, most companies surveyed reported monitoring local salary ranges to remain competitive—a strategy that is not without its flaws if it serves as the only (or primary) method for determining compensation. After all, attracting talent is only half the battle; retaining, developing and motivating a qualified workforce requires serious compensation considerations. And executives are mobile, so competition for executives goes beyond the local market.

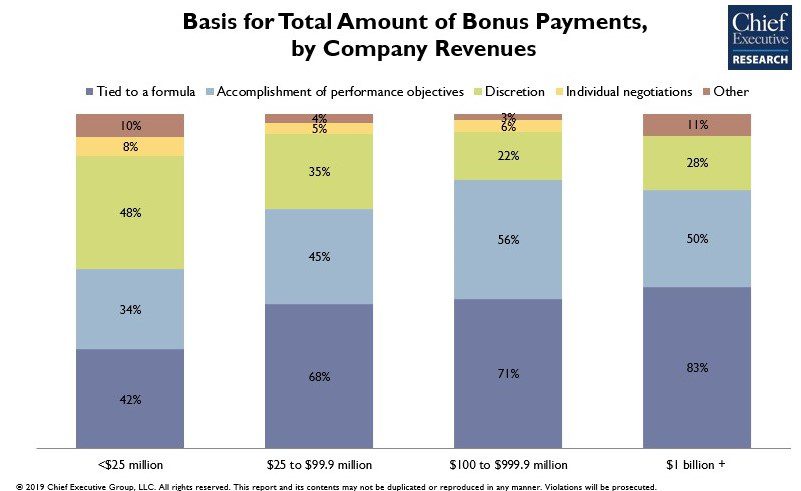

The survey also found that when assessing bonus payments, more small companies tend to leave it to management’s discretion compared to larger companies, which are more prone to using a formula. The accomplishment of performance objectives, however, remains a secondary criterion for determining bonus amounts, which can run counter to motivating employees, particularly when subjectivity takes precedence over a formula.

In the end, compensation plans should be seen as “incentive” packages, which means they should be aligned to both company and individual performance. To do so, business owners and stakeholders must:

1. Determine what the priorities of the business are (e.g., increased cash flow, position for a potential sale or IPO, increase equity value, attract and retain top talent, etc.).

2. Develop a compensation philosophy as an extension of those priorities to achieve the pre-determined business goals.

3. Establish individual/team goals, defined time horizons to achieve those goals and success metrics to measure performance objectively.

Most importantly, a compensation plan should share value that is created in the company to not only reward performance but also keep goals aligned, retain and attract talent, and accelerate value creation.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.